Summary:

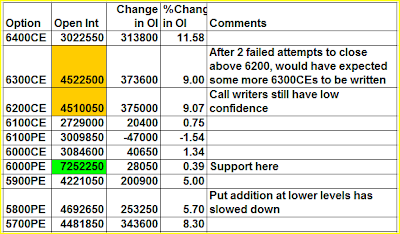

1. Yesterday's options action had "no conviction" either on bullish or bearish side. Although the price action was looking bearish, options action didn't confirm that. I say that because, even though we had two failed attempts to close above 6200 - not a whole lot of 6200CEs or at least 6300CEs were written yesterday.

2. Put writers are also scared to write puts at 6100 because of the high volatility. Only puts are being consistently added at 6000 - which is the current support for this market

3. Lower level put addition has slowed down. Will keep an eye on that.

4. PCR is now at 1.32

Nifty Futures:

2.8Cr - OI up 0.6% -- Still no sign of big OI addition

Banknifty Futures:

16.9L OI down 3.8% -- Still no addition to OI. Last few days Banknifty

Top 4 Banknifty components:

SBI - OI flat from expiry (some addition in Nov series in past two days - look to be shorts)

ICICIBANK - Small OI addition from expiry

HDFCBANK - OI down 9% yesterday!!

AXISBANK - OI flat after expiry

Top 4 Banknifty components:

SBI - OI flat from expiry (some addition in Nov series in past two days - look to be shorts)

ICICIBANK - Small OI addition from expiry

HDFCBANK - OI down 9% yesterday!!

AXISBANK - OI flat after expiry

1 comments:

Futures values for Indices:

Index : VAH-POC-VAL

Nifty : 6203-6185-6180

Banknifty : 12710-12680-12660

Post a Comment