Summary: (Looking at Nov series data)

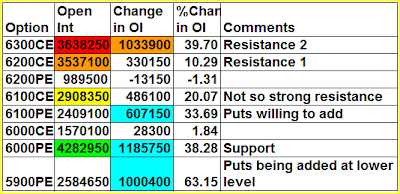

1. For the new series its too early to make any conclusions, so this is just a tracking update. 6200 seems to be the resistance but still not may calls were written yesterday. Quote a few 6300 calls were written yesterday. (Mostly speculative buyers @6300CE)

2. 6100 is a balanced level with 29L calls vs 24L puts

3. 6000 is the support with lots of puts being written there despite SPOT falling well below 6000

yesterday. Also quite a bit of lower level puts are being added@5900/5800. 5800PE has added 17L in last two days and it has the second highest OI (41L) after 6000PE

4. PCR is at 1.2

Nifty Futures:

2.4Cr OI up 38% (67L shares added to OI) -- So in last 3 days we had NET 67L additional shares have been added to Nov series. Strong rollovers/addition with Nifty massacred left and right, makes me conclude these are fresh shorts. Will change my opinion only above 6180-6210.

Banknifty Futures:

15L OI up 20% (2.6L shares added to OI) - Like in case of Nifty, in last 4 days we had 5L additional shares added to Nov series for BN. My conclusion is the same - fresh shorts. Only a rise above 12650 would make me think otherwise.

1 comments:

Corrected Values for BN.

NF : 6079-6060-6054

BN : 12304-12270-12248

Post a Comment