Summary:

1. In my pre-market post on Friday here I made a mistake of comparing Sep data at end of first trading day of series with Oct data on expiry day. So today would the right time to compare both.

1. In my pre-market post on Friday here I made a mistake of comparing Sep data at end of first trading day of series with Oct data on expiry day. So today would the right time to compare both.

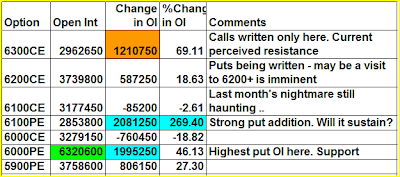

3. After the mayhem in Sep series, Call writers are still wary of writing calls. Its very clear from Friday's action - call writers don't want to write 6000/6100CEs but they are willing to write 6300CEs. So 6300 is seen as resistance "For Now"

4. Some 6200PEs were also written on Friday. Either its a fake move like we saw 6100PEs written 2-3 days before Sep expiry or a visit to 6200+ is imminent. Only time will tell.

5. PCR has now at 1.36 - nowhere near the levels we saw in SEP.

Nifty Futures:

2.74Cr - OI down 1.3% (3.6L shares cut) - Nifty OI is still down 33% from its peak during Sep series

Banknifty Futures:

17.8L - OI up 1.7% (0.3L added to OI) -- This OI is stil about 38% lower than what we saw when the breakout happened around 11400

Infact I did some study of OI over the weeked for 4 banks that make up 70% of Banknifty - SBIN, ICICIBANK, HDFCBANK, AXISBANK

All of them have very similar OI pattern! All of them have OI about 35-40% down from their their peak in SEP. Also OCT series starts off with much lower OI than what we had in beginning of SEP series. My conclusion here is lot of shorts are covered in Banknifty/Top 4 banks and now it remains to be seen if longs get added in a big way to take the index further up.

The first part of the rally is typically easy because short covering can easily give that first 5-10%. Its only whether short covering leads to longs addition that makes a rally sustainable and stronger for further extension.

5 comments:

whats your answer to this ======== said on ilango just nifty

Viren said...

I don't understand blogs which go paid and ask people to pay up for a service which till then they were promoting as free knowledge.

Has the author lost confidence in his trading job? Is he short on Income? Or was the blog a "trap" in the first place to capture viewers?

Sites like Slope of hope and Ilango's Just Nifty show the confidence the author has in his trading methodology and the fact that they can generate all the income through this methodology.

When you go paid, you are infact communicating that you have lost the ability to generate income through your trading.

February 4, 2010 10:46 AM

Sandy,

Vtrender is still a free site and Dare I say one of the best around if not the best.

Vtrender Live is an attempt to bring a trading screen and trading methodologies through a platform and a medium which is "unique and unheard of" in India.

We would have kept it free still, had it not been for certain individual who show up and disturb the atmosphere for everybody through ill concieved notions like this gentlemen who must have spent hours on the weekend going through prev comments instead of utiulising the time for something constructive.

As with our ability to make money through trading, we'll post our Sept Figures shortly.

We are up 65.66% in our trading account for the month of sept.

:-*

=))

Hi

Can I go short on bank Nifty at this level or is it better to wait? I have one lot short at 12464

Thanks

Post a Comment