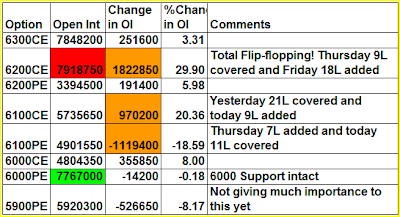

1. From Thursday and Friday's action, we can say that options writers are 'totally flip-flopping'. On Thursday we had call covering @6000/6100/6200 and Friday the writers promptly reversed it! To be precise on Thursday total of 42L calls (@6200/6100/6000) were covered and on Friday 28L combined at same strike were added. This indicates the choppiness of the market. May be post expiry we may see a directional move.

2. As per options table, 6100 becomes the intermediate resistance and 6200 the strong resistance.

3. On the puts too we had some flip-flopping but only @6100PE. 6000 still remains the support for this market.

4. PCR too is being subjected massive volatility - back to 1.2 from 1.27 on Thursday.

Nifty Futures:

OCT: 2.4Cr OI down 6% (16L shares cut from OI)

NOV: 46L OI up 22% (8L shares added to OI) - only 50% were rolled over.

Banknifty Futures:

14L OI up 5% (0.7L shares added to OI) - Small OI increase but still long way to reach 28L/35L during SEP/OCT

2.4L OI up 26% (0.5L added to OI)

Monthly Charts of Nifty/Banknifty:

Given that we are entering expiry, a look at monthly charts of Banknifty/Nifty tells that both indices are struggling to cross respective Monthly VWAP

Of the two, Nifty looks weaker as its below Monthly Value & VWAP. Banknifty is above Monthly VAL but still below Monthly VWAP, which is almost close to Monthly POC

2 comments:

Value areas

Index : VAH- POC- VAL

Nifty : 6122-6089-6075

BankNifty: 12471-12390-12370

Thanks Girish!

Post a Comment