Tuesday, May 31, 2011

Monday, May 30, 2011

Saturday, May 28, 2011

Nifty Medium term

You can catch a glimpse of that post from March 5, here.

In that post we had strongly argued about the importance of the 5550 level from a medium term perspective, making a point that if we closed above 5550 we should make it to 5900 and maybe more.

Here is an updated chart post that commentary on March 5.

This is a weekly bar chart of the Nifty spot. The rectangle in blue is the development of the profile from that date in march. We see :

a) The market stalling the upmove at the developing Point of control ( maroon line) at 5900.

b) One time frame control of the sellers from the 5900 level on the weekly time frame

c) First signs of excess this week from lower levels, which were the same as the signals picked up from 5177 back in Feb

d) Another weekly close above the 5550 level will confirm this recent excess and put the market back on the road to 5900.

Now let's turn out attention to the daily chart.

The chart above is a daily chart of the Nifty spot, having the daily point of control ( not visited) and parallel trend lines :

a) The upmove of June to November of last year has been replaced by two parallel trend lines of the same magnitude, extending down in sync with the older move.The extensions of the duplicated lines are now at 5633 and 5348

b) 5919 represents the end of the first lower parallel line from where it can be argued that momentum shifted lower. 5919 was revisited during the latest rise in March-April.

c) 5633 is the first lower extension also near the top of the brackets in feb-march as well as the one developing now.

d) 5348 is the lower end of the bracket and a move below this in march got supported by the daily POC below, creating excess as in the first chart above.

Should the daily violate 5348 now strongly on closing basis, we should see a bigger slide ahead.

The market is currently resting near the 5484 POC fairly priced at the daily.

Thursday, May 26, 2011

Wednesday, May 25, 2011

Tuesday, May 24, 2011

Failed auction

We like to think about the DD as two separate auctions and wait for follow through on emerging behavior.

It was noticeable that the market did not successfully auction in the upper distribution of yesterday.We also have the Ray Barros type failed auction today, which we last spoke about in this blog here

As we head into expiry, the deck is been stacked against the buyers for this series at least.

The market will now have to trade strongly above the failed auction point of 5417 to go higher, then take out the prior pull back low of 5446 before meeting resistance at the HVN of 5478 which was Friday's close and gap for this week.

Down lower support is at 5340 and near 5312.

Earlier today, we identified 5360 and 5427 NF as the limits for the writers at 5400. With over 140 Lakhs in Open Interest at 5400 May, the volume there cannot be ignored for the remaining two days.

Safe trading.

Monday, May 23, 2011

Saturday, May 21, 2011

Vix and the Declining volumes

At Vtrender, we are great believers in the MCClellan Readings with levels under zero pointing to a seller dominated market and above zero pointing to a market driven by buyers. Besides levels of -80 and below and + 80 and above have been great reversal points and generally signal a pause in the downtrend/ uptrend if not the beginning of a swing term reversal. There are also divergences, which make the art of reading the market through the McClellan simpler.

The addition of Vix and Declining volumes is to get more evidence of a market about to turn.As a rule, the Vix and the market tend to follow opposite paths, but even die-hard Vix fans will accept that the market does not always go opposite to what the Vix does every day.The reason is that many times the declining volumes of the index overrides, the action of the Vix and it is perilous to make an assumption on the index only on the action of the Vix.

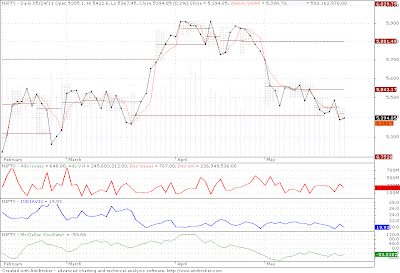

Check this chart out, courtesy RM :

The charts is of the Nifty spot with declining volumes (as a continuous line in red) in the pane below, followed by the vix in blue below that and finally the McClellan oscillator in green in the last pane.

The MCClellan oscillator is at -41 as of the close yesterday, firmly in negative territory but sporting a minor positive divergence to price.

I have marked 4 points in the chart : A, B, C, D in yellow boxes.

Whilst looking at these points, lets' remember that the VIX and declining volumes should move opposite to price. If price is decreasing and declining volumes are increasing, then the down move will accelerate. On the other hand if price is increasing and declining volumes are also increasing, then the up move will in all probability fail.

Point A : Spot near 5900. Note the position of declining volumes and Vix also marked A

Point B : The market has fallen from 5700 to 5600. The vix also falls, but declining volumes are going up.The declining volumes rectify the anomaly in the Vix here.

Point C : A up-down swing of 100 points is captured through declining volumes, whereas the Vix is flat to negative

Point D :The up move of friday seems right, as vix is down, declining volumes are down and price is up.

As a rule, read Vix along with declining volumes.

The Market Breadth charts posted By RM continue to be fantastic indicators of broader sentiment in the market.

Thursday, May 19, 2011

Wednesday, May 18, 2011

Tuesday, May 17, 2011

Monday, May 16, 2011

Saturday, May 14, 2011

Of Failed auctions and revisits

If prices move higher then we say that buyers are in control and if they go down then sellers appear to be controlling.

Most of the times, the first 60 minutes appear to be the time when the market is establishing value for the day and is referred to as the Initial Balance. This is especially the case in markets like ours which do not confirm to 24 hour futures trading and hence knowing the first 60 minutes of activity becomes very important for a trader in the day time frame.This can also be seen as Opening Range by traditional Chartists though we like to be rigid about maintaining it at 60 minutes.

As markets do not always stay within the first 60 minutes of activity the whole day, the movements outside the initial balance often produce some amazing trading opportunities for all traders.

One such trading opportunity is what we called the Failed Auction.

This particular variant of the failed Auction was popularized by a Market Profiler named Ray Barros and brought to our attention by Vandana from http://mercurycapital.blogspot.com/

Failed Auction Theory : A failure to stay outside the initial balance for more than 30 minutes (on one side), followed by a revisit inside the initial balance and an opposite move on the other side of the Initial balance.

After a failed auction, the initial move is in the direction opposite to the one that failed, but the beauty of the theory as pointed by Ray Barros is that the market will revisit the failed auction zone in about 5-6 days in over 75 % of the cases.If it does not visit back in 5-6 days then the movement after the failed auction will continue for several weeks.

Let's look at a chart to understand this :

In the chart above

a) the letters 'd' to 'q' represent 30 minutes of market activity each with d being from 9.15 to 9.45, e from 9.45 to 10.15 and so on.

b) The Initial balance is the Orange vertical line or the dotted orange lines.

c) On the 6th of may, we had a failed auction when the market moved lower in the 'k' period but reversed immediately back into the Initial balance.

d) The market continues with the momentum of the failed auction higher in next 1-3 sessions

e) The failed auction of 6/5 was revisited today 13/ 05 which was the 5th day.

Here is another example from a chart of 31/ 3

31/3 was the failed auction and a week later we were back at the same level again.

Happy hunting.

Thursday, May 12, 2011

Wednesday, May 11, 2011

Tuesday, May 10, 2011

Monday, May 9, 2011

Sunday, May 8, 2011

BankNifty Swing

BankNifty spot :

For purposes of clarity we have subdivided the chart into three zones according to the Steidlmayer distribution process. The three zones are the imbalance region A, which is the New IPM, the balancing of B region and the third region C which is the new imbalance move or the IPM as we call it here. Please note that the Steidlmayer processes 2 and 3 are actually included as one zone here as step 2 indicates start of balance whereas step 3 of the 4 step process is actually the end of the Balance process.

So we have a move in the BankNifty which on a larger Time frame has gone from imbalance to balance and back to imbalance. The question we need to ask is whether the imbalance has ended and whether we are in a new sideways move again or not?

For purpose of simplifying things further, I have given the value areas for each of the zones based on volume profile which tells us where the market developed 70 % of the Volume.

It is interesting to see from the chart that the down move had halted at the VAL of the Move A near 10662 levels and and the recent down move ( Move C) has matched the magnitude of move A with the highest volumes being distributed again in the 10880-10930 regions, which is the same as Move A

Coming to the current price, we can see overhead resistance now near 11315 spot, above which a 300 point move can be easily taken towards 11590/ 11635.

The zone of 11590-11653 if reached is a critical level and can push price lower to 11315 again or can result in a bigger drive back to 12000 if adequate buy volumes are present. Hence this level becomes like a stop and reverse for all traders across timeframes.

If the down move has to continue the bank nifty has to spend as little time as possible above 10880-10930 zone. Even in a case where the bank Nifty does that but fails to overcome 11315 then we can safely conclude that we are in a sideways market for the duration of the week.

Watch this index. It holds the key to how the Nifty would behave next week.

Friday, May 6, 2011

Open House Update

Update at 3.20 pm

1) Sell Nifty 5507, sl 5522, tgt 5485/ 5465.

Booked half at 5485. Tgt 2 missed by 3 points

+ 22

2) Sell BankNifty 10995, sl 11040, tgt 10945/ 10900.

Booked at 10945. Trailing stop hit on bal

+ 50

3) Buy BankNifty 11060, sl 11010, tgt 11110/ 11180/ 11276

Booked part at 11110. Fully booked at 11175

+ 115

4) Buy Nifty abv 5540, sl 5522, tgt 5563/ 5585

Booked part at 5565. Booked 5560. ( 2 trips)

+ 25

Total points in NF today :47

Total points in BN today : 165

Profile charts for 6th May

Tonight I will put out our pre-market analysis to all, especially to help our visitors understand the markets better in the trading room tomorrow.

At Vtrender, we are firm believers of " Planning the trade- Trading the plan". This we do through two steps :

a) A pre-market study of important levels, published every night on all 5 instruments we track.

b) Our order flow indicators which give us conviction for our trades when we execute them.

One of our readers Rajeev mentioned some time back here, that your success in trading worked to a formula he gave as :

Successful results in trading = your market understanding x ( you + trading strategy).

Had trading not involved money, our emotional natures of greed and fear wouldn't have interfered and we would have got 10 out of 10 trades right, when our market understanding was 10/10.But every good trader will tell you that there is substantial difference in paper trading and putting actual money to work. It's always the "you" which makes a difference to our trading accounts and hopefully with the pre-market study and the orderflow indicators we have tried to eliminate as much fear as possible and control greed.It just helps us to take profits and execute stops better.

Now for tomorrow's action .

The content below is copied from Vtrender Live.

------------------------------------------------------------------------------

Profile charts for 6th May

Today's updated comments are displayed in bold. Comments from yesterday and the previous days are above the bold print.

Broader market of Thursday: A quite consolidation within the initial balance turned into a selling frenzy.The range extension lower was accepted and the market closed at the lows.

Bank Nifty Futures :

- single prints at 12020 at the top.

- 11580 had the largest volumes and the region of 11580/ 11625 will resist all up moves

- 11116 is pull back high and important level for future ref.

- a NV day with close at POC

- 10864 is VAL and support

- 10815 and 10777/ 10745 are possible below val tomorrow.

-----------

- dpoc at 10800

- 10707 is support for tomorrow.

- 10621 and 10534 are projected estimates below 10707.

- resistance to upmoves will be 10794 and then 10909

- 11108 and 11306 are possible if it stays above 10909

Nifty Futures :

- single print selling from 5930 again today

- Large volumes at 5760 and 5794

-5666/76 is pull back high and single prints and resistance for any up moves

---------

- single print selling from 5593

- below 5409, 5465 and 5420 possible.

- resistance again at 5597 and 5641.

- 5565 again a ref level to the upside

------------

- single prints at 5520-5493 in the middle of the DD

- VPOC at 5460

- 5406 and 5371 are projections for a lower auction

- 5510 will resist all upmoves

- 5585 possible on auction above 5539

SBI Futures :

- Large volumes visible below prev support of 2850

- support expected between 2580-90 which are HVN's

---

- SBI had an inside day

- play break of value and range for good profits.

- 2634-2614-2606 are the value areas

- 2655 and 2681 are levels on upside

-2575 on breakdown below VAL

RIL :

- RIL continues to be weak below 1005.

- RIL formed an inside day around HVN of 976.

- region of 929-35 to provide support after the poor lows seen at 940

--------------

- RIL will continue to get resisted at 971-978

- poor highs at 964 has to be repaired

- single print buyers at open for second day today

LT Futures :

----

- poor lows at 1528 would call for a revisit there below VAL

- 1516 possible below 1528.

-------

- LT ran into resistance at 1574

- Below 1526 can see 1507/ 1487

- move above 1545 can take it to 1569 and then 1590

---------------------------------------

- Please note all above levels and use OrderFlow to execute trades in the trading room.Details on the OrderFlow indicators are under the column titled OrderFlow to the right of the blog.

Thursday, May 5, 2011

Trade BankNifty with a short bias

This tuesday, May 3rd 2011, RBI Governor raised repo rate and savings rate by 50 bps. Banknifty had already moved 5% below its peak just in anticipation of this event. To some it might seem something as simple as RBI as having preponed July rate hike and clubbed it with April hike. So Banknifty should go down another 5%, right? Afterall, most industry analysts had anticipated three more 25 bps hikes in repo rate this year and priced it in Banknifty just couple of months back at current price levels. In fact Banknifty is already down another 5% as I write this post so probably we are done going down and its time to look up and see Banknifty making new highs. I happen to believe however that RBI's action is likely to have an impact far in excess of that. Why?

Let me begin by saying that market price is a convergence of expectations of fundamentals. OK, another fundamental analyst you might say! As if we were already not drowning under combined weight of 2500 analysts espousing their views through 25 news channels and 25,000 web pages. Not really. I wrote “expectations of fundamentals” not “fundamentals”.

Wise sages of Dalal street might say so what if banks’ cost of funds has gone up, we are sure they will manage to pass most of these on to their clients. With their NIMs (net interest margins) near intact, they should not suffer more than 10% damage to their net profits. Let’s assume that there is a mega bank named Sarkari Bank of India (let’s call it SBI for sake of brevity) priced at Rs 1500 on 25th April 2011 and it has an annualized EPS of Rs 100 during quarter ending March 2011. Logically it should see its next year EPS come down to Rs 90 by some fundamental analyst and its price should move down to Rs 1350 in anticipation of that. We are already there on 5th May 2011. Our efficient stock market has anticipated this fundamental change and priced SBI quickly and efficiently. End of story? Far from it.

This is where something called PEG ratio comes into play – more precisely a resetting of expectations regarding PEG ratio. Wikipedia quotes star fund manager Peter Lynch having popularized PEG ratio (PE to growth ratio) having written that "The P/E ratio of any company that's fairly priced will equal its growth rate", i.e., a fairly valued company will have its PEG equal to 1”. Were banks fairly priced before this down-move began? Yes. When will they be fairly priced again? Well, when Mr Shortpants in the story below is done bringing it down.

In a nutshell, Mr Shortpants thinks that costs of banks have gone up but they are going to have a hard time increase their lending rates to the same extent and even grow their business at the previous year’s rate. This could be one of those fundamental changes which play themselves out over several months. Shortpants believes that banks’s growth rate will come down to 10% from 15% he had forecast in his presentation to his firm’s global head in big apple just last December. So the bank prices need to fall 50% from their peak. Hence the short bias. Now we move to technical analysis. Hard core technical guys can just view the chart and stop reading after next para.

Here is a banknifty chart (very simple daily chart with volume bars) since October 2010. The high during this period was 13,200 and low 10,020, give or take a few points. We have just seen a 400 point fall out of an expanding triangle which brought it to a much larger converging triangle spanning several months and connecting previously mentioned high and low with the next lower high and higher low respectively. A triangle as a technical formation does not reveal what it is going to do till it breaks its boundaries. So far it is holding Banknifty right at lower edge but given the change in “expectation of fundamentals” initiated by RBI, I am hoping for a breakdown of 10,800 level and Banknifty to travel to 8000 in next 3 months. Accordingly I am going to be short on every major pullback from now on till end June. In fact I am already short. Will it really come down to 8000 and that too this year? Do converging triangles spanning several months on daily charts actually work like that? Well they don’t, but Johnny Shortpants sure does. Read below for more boring stuff.

Chandrashekhar

Disclaimer – all the characters in the story below are fictional and any resemblance to any character – living or long dead – is purely coincidental. Also everyone makes mistakes and so do I, so don’t take me too seriously. If you trade based on my views and loose money, my condolences in advance. If you make money however, send a USD 100 cheque to undersigned so I can keep writing similarly inane articles and stories in future as well.

Story - Short and Long of Banknifty

Johnny Shortpants is a 33 year old Harvard MBA and controls USD 10 Billion fund investing in Indian equity markets. Marketswamy Longrajan is a career banker serving his 33rd year as head of biggest domestic institutional investment firm and has similar funds at his disposal (his Master’s funds actually which happen to be his Master’s subjects’ funds actually, but more on that later). They share a keen need and skill for pleasing their masters and advancing in life thereby propagating their species. Darwin’s law – survival of those who can adapt.

At 11 AM on 3rd May 2011, Johnny is a smug man. He has seen this repo rate hike coming and has already shorted SBI to the extent of 1000 crore in futures, sold 400 crore in cash, written 200 crore in calls etc to ensure that he is prepared for this hike in rates. He is already invested to the extent of 10,000 crore in Indian banking sector and has booked some profits in the previous quarter. His masters have determined that Indian market is going to underperform in 1st half this year (was he the one who suggested it himself?) and he is ready to make the most of a bad situation. Just 10 minutes later, he is a worried man. RBI has not only hiked the repo rate by 50 bps, it has also hiked up the savings rate by 50 bps. A rational capitalist to the core, he was hoping RBI would pay lip service to a policy of a gradual freeing of savings rate or something to that effect. Why the hell did they have to do it today? They were contemplating freeing up savings rate for so many years without doing anything about it so why did they have to act on it now? Shortpants scans through policy and starts worrying about things he normally did not worry about in the past. That’s the thing about worrying. It begets more woes just for company. Banks’ doubtful loan provisioning norms have been further tightened as if those were not tight already. Why can’t RBI run Indian banks like good old Fed of NY, US? Let them bundle those doubtful loans as securities and sell it to their own clients as high grade investment. Surely, invisible hand of market will ensure everything turns out fine. To make things worse, RBI Governor has also told banks not to park surplus funds in liquid MFs. How will Banks lend this additional 50,000 crore out without competing more aggressively among themselves? Hell, some of them may have to start working on Friday afternoons to get more business! No one becomes a banker to face this kind of world! Shortpants figures that most of Indian industry was already not investing aggressively into new projects and capacity creation. Home loans volume was already declining due to all time high home prices and a sticky real estate market fuelled by black money. Auto loans were growing really fast but those had already climbed to 15% for most borrowers. How much more can banks increase rates without demand taking a hit? Plus his analyst had figured that RBI would stop increasing repo rate in August and might even hike it once or twice before March. That would have given a nice 5-10% kicker to banks’ earnings given that they need to mark-to-market their long term Govt securities, but that seems a distant possibility now.

Its already 11:30 AM and market is not taking nicely to the RBI policy. Shortpants has decided that his performance for this quarter will be adversely affected if he does not actively short Bank stocks. He can’t just dump his stocks on market – 10,000 crore is not a small amount – so he decides to play it smart. He will start by shorting Banknifty future to the extent of Rs 100 crore only everyday; something he has already been doing last 10 days. Banknifty is going to drag Nifty down too so he is going to let his fund write calls aggressively in Nifty and buy some puts too. That will give a boost to his fund performance this quarter. His plan in place, he calls for a lightening meeting with his staff and issues instructions. A bright girl from IIM-A alerts him to the possibility that his masters may actually ask him the reason for his actions. Shortpants is a trader and is given by nature to act on his hunches but he’s also worldly smart having done his thesis from school of CYA after he finished his MBA from Harvard. Shortpants asks the IIM-A girl to prepare a report along the following lines and email it to HQ from his email ID before London market opens. Maybe she will get a nice raise in the upcoming appraisal.

SBI price = 1500

SBI EPS = 100

SBI growth rate = 15%

PE ratio of SBI = 15

PEG ratio of SBI = 1, hence fairly valued, hence all the previous decisions about buying into SBI have been correct. Going forward however,

SBI expected growth rate = 10%

Expected PE ratio of SBI given fair valuation = 10

SBI EPS for next year = 90

Hence, fair price for SBI by March 2012 = 900

He’s ready with a justification for shorting SBI till it reaches the highly logical and inevitable price point in his terse and sharp report. Plus he is going to be the first one to short and get out, like he always does. He knows Longrajan will buy every alternate day whenever bank prices come crashing down but he also knows Longrajan is not an aggressive buyer. He buys and pauses for further fall in market. That’s the way he’s been operating in this market for decades and it works for him. Longrajan’s masters do not pay him for taking risks but for playing it safe and slow. In fact Longrajan’s masters do not pay him enough to do anything. It’s a wonder that guy shows up at work. Shortpants picks up the phone to call his friend who needs to be given an advance warning otherwise he won’t be welcome to Beachwallah’s annual Roman Orgy theme party coming Friday.

Beachwallah is a worried man – he always is. Market is on its way down and the call from Shortpants has got him worried more. You see, Beachwallah business has something to do with people buying and selling. When Banknifty goes down a lot, people buy lesser and lesser. Plus he has his own 1000 crore invested in SBI. Now he has to take a bad situation and make the most of it. First he instructs his trading head to buy puts on SBI. As many as he can. Next, Beachwallah calls his bright non-descript MBA analyst from next room and asks him to prepare a report on SBI along the following lines.

a) SBI price last week = 1500

b) SBI price today = 1350, hence SBI is cheap

c) SBI is a good blue chip bank

d) Therefore, Buy SBI on every dip

Report has to be simple otherwise BW’s clients won’t understand it. His analyst leaves the room shaking his head in disbelief and cursing the day he decided to join a top notch brokerage firm. His gold medal and MBA degree hangs on his cabin wall mocking him. BW issues instructions to his team on how to go about circulating report and which faded out former star traders should espouse the cause of SBI on TV channels and in what order and then leaves for early lunch at Cricket Club of India. He whistles while he contemplates how and when to give a muddled and unclear warning to his lunch buddies about pending fall in SBI once he is done buying his puts.

Wednesday, May 4, 2011

Tuesday, May 3, 2011

Open house- May 6th.

Whilst understanding the ebb and flow of markets, it is essential that you trade with a methodology that is simple, accurate and does not distract you from the immediate purpose of understanding what message the market is trying to give.

Too often, traders run around chasing multiple trading systems and indicators when a simple understanding of price and volume is enough to see the message from the market.

Fact No 1 :It is a fact that 90 % of traders will lose money in the markets. Ask any relationship manger of any prominent brokerage and he would not recollect the name of the person who opened an account with him six months back!.

It's a pity, because given some education and some professional help, the trader would have been able to generate profits far more than what his fixed deposits would assure him every year.It's only lack of education and lack of professional expertise which guarantees failure to an unskilled worker, not just in the financial markets but elsewhere also.

The traders' reluctance to seek any kind of professional help whilst trading the markets dominated by large institutional houses and skilled professionals puts him at 1: 10 odds to win in this jungle.Our new trader instead would put at risk his thousands (and even lakhs) on some fly by night operators and free agents many of whom will further confuse him with their elaborate use of different tools/systems to explain the one same market.

Fact number 2 : All the moves of the market can be explained in one common universal trading system.If your system is not equipped to give you a similar level of results for trending and range bound markets, change it !

Fact number 3 : Our financial markets are dominated by institutional players. Most good traders will look at FII/ DII buy-sell figures everyday.

On the 6th of may, the coming Friday we are conducting an "Open House" to give you a small preview on the way we approach a trading day and our systems and tools.We will give you a one day free access to our trading room, to discover for your- selves a system of working guaranteed to cut your losses for the market.

What you can expect from the Open House:

a) an Overview on how to organize your day and what to expect during it.Know very early when the market will move big or when it will be range-bound.

b) you will learn how to track institutional money flowing into instruments. You cannot bet against large institutional money in these markets as they are known to defend their positions aggressively.

c) An open Q & A on all aspects of the market.

d) Live Commentary during the day on emerging market action, including proper levels for stops and targets.

And much more.

Invitations are open to all, but registrations will be required to enable us to issue you a password for the event.

Open house will be a walk-in between 9.15 to 3.30 and you can join us at anytime.

Send a mail to vtrender@gmail.com for a free invite.

Careful here !

This time the b shaped profile from yesterday worked well to the south side despite all the volatility in the BN futures in the morning.

NF stayed well below 5637 all morning.

So we have broken out of the previous range and now seem set at the top of the previous bracket between 5570 and 52XX .

There is a balanced profile at 5565 as an HVN ( not in chart) and should be an important ref level on the downside.

A rejection of this level, can act as a catalyst for a move through the previous balance and visit lower near 5350

Monday, May 2, 2011

Notes from V2

We keep 5 charts in the trading room : Nifty, Bank Nifty, RIL, LT and SBI.

Every night an update is sent to prepare the trading room for next day's major moves.

Here is a sample post from Friday's close

Bank Nifty Futures :

- 11580 had the largest volumes and the region of 11580/ 11625 will resist all up moves

- below 11450, Bn can see 11366 and if that does not hold then 11280/250.

Update at 11.30 :

- High of 11588 and low of 11290.

Nifty Futures :

- Large volumes at 5760 and 5794

- above 5795, NF can move to 5823

- below 5764, lows of 5733 and 5702/14 can be seen again.

- a close above 5827 will pit NF on track for a 120 point moves to bal highs at 5948

- a close below 5714 will bring 5630/ 5570 next.

Update at 11.30 :

- High of 5790 and low of 5730.

SBI Fut :

- The inside days have set up a powerful move in sbi and re-entry into a prev bal zone.

- Large volumes visible below prev support of 2850

-2772 and 2722 are supports on way down.

Update at 11.30 :

- low of 2727 made.

RIL :

- RIL formed an inside day around HVN of 976.

- 971 forms the lower extreme, below which it will vist 956.

- above 988, 999/ 1004 are possible.

Update at 11.30 :

- High of 985 and low of 974.( still inside)

LT :

- Like SBI, LT had an inside day and broke supports this week.

- large volumes visible at 1605.

- below 1596, 1582/ 1567 are possible.

Update at 11.30 :

- low of 1569 made.