Last weekend, when we looked at

mid term and short term charts of the Nifty spot, we identified two regions for the Nifty, one around the 5550 zone for the medium term and another around 5472/93 for the short term.

At the end of the week, the Nifty found itself closing below both the mentioned levels.

In a trading environment, which is increasingly being dominated by news flow from east to west and with the mid-east also demanding attention it pays to be extra careful in the markets, regardless of what the technical picture may be projecting at the moment.

It's not a time to be too adventurous with leveraged positions, but to be careful with a good understanding of risk-reward for short term trades.

Come Monday, the news flow from Japan and the EU conference will affect our Asian markets and the Europe open one way or the other. We also have the RBI policy which can keep the Banks muted in the early part of the week.The Bank Nifty did not support the down move of yesterday afternoon and without it's participation it is difficult to see the larger Nifty move strongly during the week.

Let's turn out attention to the Nifty March future with an eye on what the expiry may be on the 31st of march.

I'll like to break the remaining part of this series into two parts, with the trend being mild to moderately bearish for the coming week and a shift to mild bullish as we come closer to the expiry week.

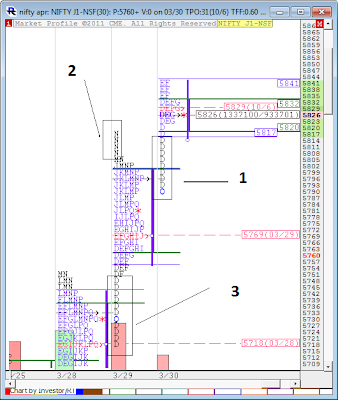

The observations are from the chart posted below. I'll elaborate :

Based on last weekend's post and the fact mentioned at the top that we could not clear the week above 5472 and 5550, we may be headed towards 5377 and 5340.

The composite profile shows heavy volumes now at 5500 regions which could be new shorts having entered the market yesterday. Certainly the region around 5500 would be a stop and reverse for the rest of the series.5300 should be the extreme end at which the market can go to, below which the new buyers ( green candle in the pane) would give up all hope.The low volume zone around 5400 has not indicated a great preference for auction ( as expected in profile), with two 50 + point moves above it this week.The vwap for the series is 5460 regions where we closed yesterday and seems to suggest that the bulk of the volume is below 5500 levels for the series which is also the preferred region for auction.On two counts therefore, 5500 would be a good stop for shorts.

Now for the second part of the series, where the outlook should be bullish.

Last March, we had an amazingly profitable time at Vtrender with our theory on seasonality and markets. You can catch that

post from last march here.

Basically the theory is that the month of March is a profitable series for bulls and should close at the highs.Now like all theories, this one also needs to be taken with a pinch of salt, but profile also teaches us that markets have memory and tend to do things which they have often done many times before again and again.

So we'll watch for the bearishness to subside and the bullishness to begin.

To that end, the news flow this week should help.