In my

Last post I had mentioned that the noise around the settlement day was not clinching evidence to signal a change of trend but to quote from that post again " Sometimes what didn't happen has more implications than what actually occurred."

The open was crucial as a follow up to that afternoon's move and the open left nothing in doubt.

The sellers managed to take the Nifty future down 150 points in a session before some exhaustion in the Bank Nifty and some opportunistic buying as well as short covering in the Nifty future managed to take the Nifty up about 70 points from the lows.

The area around 5625 was a high volume zone noted at the close of trading on the

27th. In hindsight it represents the area where new sellers have entered the market and are ready to pin the market lower.

People who follow parameter based indicators would recognize this zone as the 200 DMA.But believers in market generated information should not hold any level as sacrosanct or too big for the market to scale.

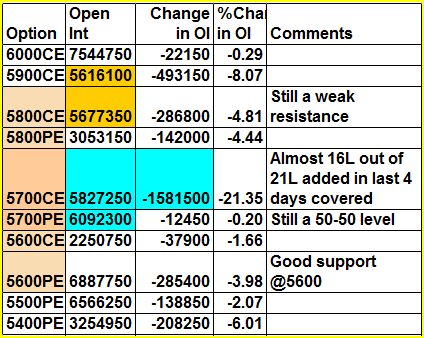

Strength above 5625 will put 5685/ 5725/ 5785 in play. Each of these levels will be used by sellers to re-enter short positions in the market.

Looking down we have Friday' s 5481 and then 5435 and 5373 as the next major supports for the market.Break of one should lead to the other.

For those of you who were wondering what happened to the OrderFlow chart of the Bank Nifty

after my intra-day post, here it is :

The profile picture posted yesterday put in a poor low at 10530, in itself a reason to revisit that level again. We'll see if it breaks the second time it gets there.

To close, I drew up a chart to represent the times, the Bank Nifty has been out-performing the larger nifty.

Have a Look :

It's a 40 day chart where Blue represents the BankNifty future and the Green the Nifty future. It's only from the 24th that the BN has been out performing the Nifty.The banks are important to our investment portfolio and we'll continue to keep an eye out for this relative strength.

The ratio of the two is turning into a contrary indicator with an upswing marking a decline in the indices and vice versa.

Some thing to chew about over the weekend.

Have a good one everyone. !