Summary:

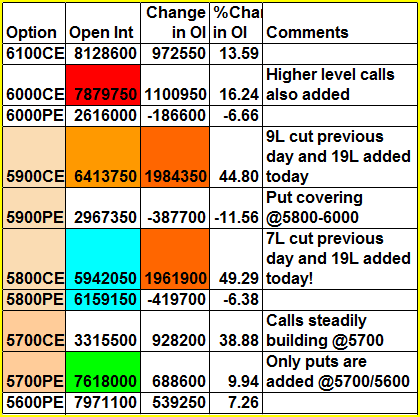

1. The best analogy to describe the state of Nifty as depicted by options table is -- In some movies the car of a hero goes near a cliff and gets stuck at the edge and is absolutely precariously balanced. And all it needs is just a bird or a small monkey to come and sit on the hanging edge and it can nosedive! But the question is - will someone push it on the other side of 5700? In spite of this if bears can't manage to take it below 5700 then its a very healthy sign that 5700 would remain as a strong support for this market in future.

2. Options data did a full U-turn as did the market and now we are back to 5700-5900 range. 5900 becoming the resistance with 19.8L calls added

3. 5800 is the 50-50 level now - again 19L calls added. (7L were covered previous day and now 19L added!)

4. Support exists @5700 - but the bias is negative.

5. PCR now makes another U-turn frim 1.01 to 0.94 -- a new low we have seen so far in 3-4 months!

Nifty Futures:

21.2L OI up 5.5% (11L shares added) -- That's pretty decent OI addition! Longs? Shorts? -- Only a break of 5700 on downside and 5880-5915 on upside will confirm.

Banknifty Futures:

13.5L OI up 2.5% (0.3L shares added) -- After only OI reduction in last few days finally some increase. Again only a break of 10630/11280 will decide the fate of this market.

Friday, January 14, 2011

Subscribe to:

Post Comments (Atom)

2 comments:

Thanks Girish.

I posted some more analysis to back up the "car on the cliff".

It will get pushed or pulled.

New post.

Thanks Girish!

Post a Comment