1. The last 2 hours of short covering in Nifty/Banknifty seemed like the market was paying back bears in the same coin for what they did last Thursday and Friday.

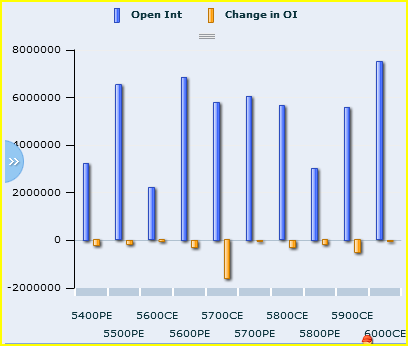

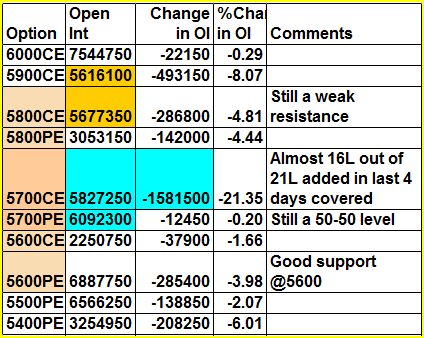

2. The OI table is an interesting juncture where 5800CEs have less OI than 5700CEs! So I don't know what to say about 5800. For lack of better words, we have to call it resistance but its hardly a resistance if some massive buyer steps in and decides to take the index up. But the question is - does someone desperately want to buy Indian stocks? - esp given inflation/rate hike and high commodity prices (Oil/Copper ...)

3. 5700 is the 50-50 level, although a very big chunk of calls were covered yesterday. Now all that is left is the 22L calls that were added on last Friday.

4. 5600 still a decent support, although I would have expected puts to be written not covered!

5. PCR slightly up from 0.88 to 0.91

Nifty Futures:

Jan: 2.08Cr OI down 4% (4L shares cut)

Feb: 33L OI up 27% (7L shares added) - Decent rollovers happening and given that we have only 3 trading days in next week, I would expect one more massive 100+ point day in next 4 sessions to facilitate large rollovers

Banknifty Futures:

Jan: 11.4L OI down 5% - As mentioned yesterday, Banknifty OI is at probably six month low. A sweet SPOT for some market maker to enter and create a rally or Indian Banks is a yesterday's story?

2 comments:

Thanks Girish!

New post

Post a Comment