Thursday, September 30, 2010

Slaughterhouse

Definition of a Pig : Greedy short term player, looking for small profits with big risk and no knowledge of the markets.

At yesterday's close we had mentioned that the buildup at 6000 CE which was around 24L was speculative and certainly not smart money.

By Afternoon the CE buildup at 6000 CE was another 22 Lakhs, and that's where it was evident that the market would go for the kill.

...And Viren unleashed his now famous Option call.

at around 1.40 pm. ( in the comments of the previous post)

The result- All the 22 lakhs added intraday covered + another 20 Lacs from yesterday evident in the final OI figure at the 6000 CE which stands at 56 Lacs now against the 76 Lacs yesterday.

To the uni-initiated, the purpose of writing a call is to gain from time decay in a side-ways market.You don't write an option with one day to go.

There is no time factor in an option set to expire the next day...

Anyways here are the charts for October :

The two yellow lines are where the seller operates from.The lower single yellow would be the support

Even today, when the market reached the top end of the Vix range estimated in last night's post. it sold off.

The Bank Nifty has done the 80 % rule twice this week.Getting above 12405, it climbs even higher.

Risk in that position can now be easily managed at 12305.

Have a great October trading the markets. Be a Buyer, even a seller, don't be a pig.

Stay informed.

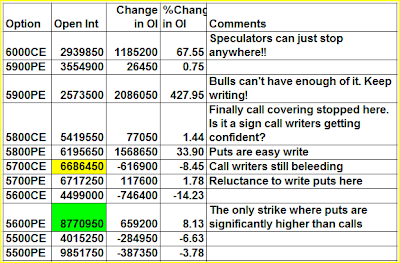

September Expiry

I had mentioned last time when we covered the Open interest before expiry, that smart money tends to move to the next month for all hedges, a few days before expiry and any big changes in Open interest on the penultimate day or even the day of expiry has to be greedy speculative money who inevitably get slaughtered.

We saw it happen last time when the market moved around the 5500 strike killing the CE writers who had built a substantial open Interest the previous day.

Let's look at what's happening at 6000 strike from the past five sessions in Sept and in Oct too.

The PE writers added more at 6000 than CE writers today in October clearly indicating that the build-up in CE OI at 6000 Sept is speculative and may not be smart money.

The range indicated by VIX formula comes to 6064-5931 for tomorrow.

5961 is the developing Value high for the month and 5947 a previous HVN which has supported price in the past.

It's doubtful whether we will see a large movement below 5961-5947

6040-6047 still remains the zone where the seller operates from and any move back to that point will be used for more selling.

In Sum, the market looks like it will auction around 6000 tomorrow.

Wednesday, September 29, 2010

Mid- day report ( 29/09/10)

The highlight of the day so far has been the 80% rule workout in the Nifty as well as the Bank nifty.

It's amazing to see this rule work out despite the many other obstacles in the path of chart analysis.

We are watching support to hold in the 6003-6010 zone beyond which 5995 and 5979 are known reference points.

Failure to hold 6003 will discard the double distribution theory.

We have identified 6040-6047 as the inflection point for this week beyond which 30-40 points can be made either direction.

Trade well.

Options/futures data for 28th Sep (EOD)

1. Options table is getting simpler. 6100 is the resistance with 74L calls vs 53L puts. BUT, the most noticeable trend in last two days is relentless addition of 6100PEs. If it continues expiry closer to 6100 becomes a possibility.

2. Support at 6000 remains strong with 83L puts vs 52L calls. Looking at call covering at 6000, it does seem like expiry above 6000 is a very good possibility.

3. PCR has hit 1.98! The high PCR has almost capped the rise in this market until expiry.

Nifty Futures:

SEP: 2.1Cr OI down 16% (41L shares cut from OI)

OCT: 1.8Cr OI up 35% (47L shares added to OI) -- First time we have seen strong rollovers in Nifty.

Banknifty Futures:

SEP: 14L OI down 16% (2.8L shares cut from OI)

OCT: 8.7L OI up 34% (2.3L shares added to OI) -- Rollovers in Banknifty have picked up since last two days.

Tuesday, September 28, 2010

EOD Update 28th Sept.

Nifty :

And the Bank Nifty.

The highs of the day were near Value Area Lows from Yesterday...

Options/futures data for 27th Sep (EOD)

Summary:

1. 6100 has finally proven to be the resistance as the call writers there seem to know what they are doing unlike call writers at the beginning of this month.

2. 6000 is still a decent support with 82L puts vs 53L calls. Although the intraday fall yesterday made a few put writers cover.

3. Quite a bit of calls were covered @5900 indicating that the expiry could be definitely higher than 5900. So the immediate range for Nifty is 6000-6100

4. PCR is at 1.94 and my yesterday's quote "with PCR so high, a serious rise from here is not possible pre-expiry" - is still valid.

Nifty futures:

SEP: 2.53 Cr OI down 18% (55L shares were cut) - The heaven sent gap up was used by longs to book profits.

OCT: 1.34Cr OI up 32% (32L added to OI) - 2/3rd were rolled over - rest profit booked!

Banknifty Futures:

SEP: 17L OI down 6% (1.1L shares cut from OI)

OCT: 6.5L OI up 25% (1.3L shares added to OI) -- First time rollovers were decent. But still BN has had a lot of profit booking from its breakout point.

Monday, September 27, 2010

EOD report 27th Sept

We anticipated the open up, booked our overnight longs from Friday and even took a short trade to the downside.

Afterall it was a Market profile 3 I- follow up day, one whioh plays out with an 85-95% probability rate as my fellow traders in the Trading room are discovering.

Have a look at the chart :

We spoke on Friday about a high being printed before 10.30 am.

Nothing magical, just pure observation and practical application of Market profile!

In the Bank Nifty, we were even more happier to book out longs from Friday at 10350, a sweet gain of 90 points for an overnight hold.

As Shai says, Market Profile is much more than knowing three values on a chart everyday.

If knowing VAL, VAH, POC has helped you, just imagine the difference it will make to your trading if you know how to employ the other practical concepts behind Market profile in trading everyday.

Join the Trading Room to find out !

Options/futures data for 24th Sep (EOD)

Summary:

1. With market making strong move above 6000, the action at 6000CE/PE was similar to action at 5900 a few days back. 6000PEs added 20L to OI and hence 6000 now becomes the support. Lets see if this level holds for expiry.

2. Calls covered across the board from 5800-6000. Only at 6100 very few calls were written. May be the fear of a Monday gap up. As of now 6100 is the resistance with 62L calls vs 20L puts.

3. Put covered started at 5900 now. Its been the feature of this market. As soon as the market takes one stop higher, lower levels puts start covering right away.

4. PCR is now at 1.93! Even though we have had very high PCR for last few days, the market has given only intra corrections of 70-90 points. But with PCR so high, a serious rise from here is not possible pre-expiry.

Nifty Futures:

SEP: 3.1Cr - OI down 6% (19.5L shares cut)

OCT: 1Cr - OI up 26% (21L shares added) -- First time in several days we had good rollovers.

Banknifty Futures:

SEP: 18.6L OI down 12% (2.5L shares cut) -- Banknifty OI is down 50% now from peak. Some rolled over to SEP but still a good amount was profit booking.

OCT: 5.9L OI up 32% (1.25L shares added)

Sunday, September 26, 2010

Market outlook for 27/09/10

Bank Nifty closed up 117.25 points (0.97%) at 12263.55 whilst September Future closed at 12295.65 premium of 31.1 points.

- FII bought in Cash (Net buy 1149.8 Crore)

- FII sold big in index future and stock future, bought in index option (Net sell 1046.89 Crore)

- DII sold in Cash (Net sell 879.83 Crore)

- US market ended in GREEN.

- Global cues are positive.

- SGX nifty is positive as of now.

- Most Active Nifty September Call Option: 6000 and 6100.

- Most Active Nifty September Put Options: 6000 and 5900.

- Advance Decline for the day was 938:412

Current Spot: 6018.30

Pivot: 6000

5DEMA: 5971

10DEMA: 5897

20DEMA: 5775

50DEMA: 5604

RSI (7 days): 80.12

Supports: 5970 - 5922

Resistance: 6048 - 6077

Nifty Future VWAP: 6006

Bank Nifty Future VWAP: 12223

MP Values Futures: VAH - 6040 POC - 6031, VAL - 6000

MP Values Bank Nifty Futures: VAH - 12290, POC - 12270, VAL - 12219

Friday, September 24, 2010

Percentage of Positive and Negative Closing in Nifty

Bank Nifty Trading

I was going through the trades we have done in the past two weeks to iron out chinks.

One statistic which caught my attention has been the performance we churned out in the Bank Nifty.

We made a lot of heads turn, when we said that the Bank Nifty was more suited to our style of trading.You have to be quick, it's volatile, it's risky were some of the adjectives which were thrown

The Bank Nifty has changed a lot from the time the regulator made it into a 25 point size, bringing much needed liquidity to the index. I still remember the times when the bid-ask spread was so huge, one could drive a truck through it !

Anyways here's the chart :

We trade in this index when we find a good trade location with risk easy to manage.

Our win/ loss record is 12/3 for the past seven sessions we took trades on this index with a return of 486 points. In the same period the Bank nifty has moved from 11900 on the 14th to slightly above 12300 today for a total range of 400 points only !

The best part of the whole exercise is that in the trading room we have individuals who were calling out trades by themselves today.Our first trade this morning was noticed by and called by people from our trading room.Our Live charts with our system of trading engraved are delivering results and we are happy with that.

So it is not us who are getting these points in, it's the system of trading we employ in Market Profile which gives the results !

If you are not in Vtrender Live, you are certainly out of a lot !!

Mid-day report ( 24th Sept)

There was little doubt that once yesterday's 5947-5976 was resolved, we would see strength above 5990 levels.

We initiated and booked some very good trades so far :

Consider these intra plays :

*Long Nifty at 5984.

*Long BN at 12170

*Long LT at 1292

*Long Axis bank at 1482

It's always better to know the type of day unfolding if you wish to be a good intra day player.

Have a good weekend.

Options/futures data for 24th Sep (EOD)

Thursday, September 23, 2010

EOD Report 23rd Aug

Yesterday after about 2 weeks and 500 points of an upmove, we had seen range extension on the downside and were willing to speculate that step 2 was done and we were in early stages of step 3.

We also had a balanced profile from 2 days back to shore up that claim.

The Nifty broke down 2 times from the IB low of yesterday before finding support near the HVN at 5945 which will be a big refernce point into tommorow's action.

5990 and 5947 given in my mid-day update both served their purpose today and would be useful tomorrow as well.

The BN gave a very good demo again for the 80% rule first up in the morning, netting us a sweet 40 points to begin the day. Later On, a trade taken below value in the same index fetched us another 70 points in trade profits.

The index is still within range of the past three days and we are looking forward to a break for some good trade opportunities.

Mid-day Update 23rd Sept

5978 is the value low in the Nifty and 12260 is value high in the BN.

The BN is operating within range of yesterday which itself was an 'inside day'.

Use 12260-12210-12200 to detrmine your direction in the BN as also 12147 & 12338 which represent the range.

In the Nifty, we have reason to believe that we are in step 3 of the Market profile 3 step process and we can expect a vertical move within the few sessions remaining for this expiry.

The direction is not resolved still, but we are using 5990 and 6010 as short term refrence levels to the downside and upside respectively.

5947 and 6048 beyond the above mentioned levels will shape up the trend for the remainder of this expiry.

Options/futures data for 22st Sep (EOD)

Wednesday, September 22, 2010

EOD Update 22nd Sept

The Nifty's ATR is a bit more than the BN currently and the 40 point swings we see in the NIfty may not end soon.

It's a good day trade environment and if you are not quick in this market, you will be caught out for sure.

The BN traded within the range of yesterday and is currently in step 2 of the 3 step process. There may be a little more action in the BN tomorrow.

Trade light. Trade quick. We are expecting a lot of volatility in the six remaining sessions for this expiry.

Options/futures data for 21st Sep (EOD)

Summary:

Summary:Monday, September 20, 2010

Options/futures data for 20th Sep (EOD)

Mid- day report ( 20/09/10)

The momentum from 5485 levels is still driving the indices higher.

At this stage, we are expecting a pause, but it remains to be seen what the market gives.

5905-5914 are intra levels for weakness. Further down would be 5875 and the big one at 5803 would signal a trend change.

It's a treacherous market to trade...You cannot add fresh longs at these levels for the short term and there is no perceptible weakness shown by the market to short.

If you are short in these markets at these levels, you are short only on your view of the market.

That having been said, the longs from lower levels need to be carried forward with insurance.

Options/futures data for 17th Sep (EOD)

Summary:

Summary:Sunday, September 19, 2010

Saturday, September 18, 2010

Weekly Report

First, the market is an auction process which moves up or down until buyer seller demand arrives at a defining point where is is equal or where we say equilibrium or balance has been reached. This is what we call the Point of Control or POC an excellent tool to interpret day trade movements.

Second, the market either moves sideways or vertically around this balance zone depending on whether the current buy/ sell demand is relatively in or out of balance.

For our swing trade requirements we also use the same method also called the Market profile 1-2-3 method.

The only difference is that we look for the action across different day profiles, not just one.

In step 1 we look for a directional move, typically out of a high volume area.

The yellow rectangle in the Nifty chart above is a good example of this.

Currently at 5914, we have reason to believe that step 1 may be over. A confirmation would be awaited in the action this coming week.

Now in step 2, we look for the directional move to get over. This can be located by the appearance of a 'p' shaped profile if the instrument is in an uptrend or a 'b' shaped profile if the instrument is in a downtrend. Ideally this should be followed by the formation of a bell shaped profile or balance being achieved in the next few sessions.

Step 2 is actually a process of the market going sideways or trading a 'bracket' as we call it in Profile.It's one of the more difficult environments to trade.

In the Bank Nifty chart posted above, you have very good examples of step 2 in action.

The purpose of step 2 is to find the balance for the move which unfolded.

Once step 2 is formed and the balance noted, step 3 unfolds.The buyer seller relationships and shapes of profiles in the balancing method have enough cues in them for step 3 which again is a big directional move.

Step 3 is a large directional move out of the balance area of step 2. A completed step 2 will tell us to no longer look for a range trade but for a step 1 directional move instead.

Bottom Line :

There are important clues in terms of the steps of market activity and volume analysis to help us determine a buy and sell strategy for the next directional move of the market.

Order Flow represents a unique paradigm for understanding and anticipating market activity.The key is to stop trading in terms of price only and start organising trades according to market structure.Trade Market Time, not clock time. Buy the time in your trade, not price. !

I'll leave you with this chart which we picked up as a trade on Friday :

Friday, September 17, 2010

Options/futures data for 16th Sep (EOD)

Thursday, September 16, 2010

Vtrender Live

Get real time information as it happens through our audio-video platform.

In our trading room we give you all the information on our thinking on trends, range estimates, types of days etc in enough detail so you can learn to do it yourself.

Shai who conducts the Live sessions, simply left even me dumbstruck today when he called out two trades on the bank nifty today live with all that volatility around.Now I've known Shai for many years, but the precision left even me amazed today.Mind you, the trades were on proper MP levels and with experience even you would have called it.

Here they are, just after the news :

Short Bank nifty at 12020, stop 12080, tgt 11960/ 11910.

Target of 11960 reached . TSL at cost suggested..

Long Bank Nifty at 12055, Sl 12010, tgt 12090/ 12255.

Booked out at 12195. Went to hit 12246.

If you want to know more on how we call out these trades, then join out trading room.

We share our experience in trading, have a laugh and make money too !

Subscription options on the right. For Online payments/ bank transfers send a mail to vtrender@gmail.com.

Mid-day Update 16th Sept

The highs have been at 5877, marginally better than the 5875 from yesterday.

The seller operates there.

Below 5840 which is VAL, is a conservative short for a possible 5805 today.

A break above 5877 will put in firmly in control for 5913 later today.

All eyes are on the Bank nifty, which is not showing a lot of participation at the moment. We have noted the presence of some put buyers at 12000 and 11900, but all that can be just anticipatory.

A break of 11960 BNF will be the first sign of weakness, followed by a break of 11910 as confirmation.The target can be 11755 on the downside too, if some aggressive selling happens later today.

Options/futures data for 15th Sep (EOD)

Wednesday, September 15, 2010

EOD Update 15th Sept.

Viren will be doing a regular update at this blog everyday at noon and if you have been a visitor yesterday too, you would have caught this move in the markets today.

" As long as the POC is protected there is no danger to the uptrend.

The POC is 5761 in the NF and 11840 in the BNF"

Prophetic words in the post of yesterday afternoon.You have to read both posts of his to see how he uses the message from the market to make his trading plan for the day.

The big moves seems to be coming early in the day and we have seen it on a couple of occasions already.

The chart of the Nifty seems to be suggesting a slight cooling off or a sideways action for the next day or two.

The action seems to be in line with the Market Profile 1-2-3 pattern with 1 over and presently we are in the 2 phase.

At Vtrender 2 we use the message from the market not for intraday trading only, but for swing trading as well.

From the start of September we have managed to close about ten swing trades profitably.

Have a look :

Market profile works in all conditions and across time-frames.

Vtrender 2 is your opportunity to know how it happens!

Mid-day update : 15th Sept

The markets have opened strong in value and in range implying that the sentiment has not changed much for yesterday which was a bullish day.

We have gone on to meet our IB projected target of 5873 and it remains to be seen how the market reacts from there.

Either we will continue strongly upwards towards 5894 or come back to 5842 levels.

In view of the RBI anouncement tomorrow, the Banks are very sluggish today and the Bank Nifty is the weaker of the two indices.

The Nifty is being propped up by the likes of Reliance and ONGC today. That's a change!

Options/futures data for 14th Sep (EOD)

Tuesday, September 14, 2010

Mid-day Update (14th Sept)

We had a 2I day yesterday, which gives an almost 80% chance for the high of the day to be in already. A 3I day would have given us a 97% probability.

The IB range of 87 points is the biggest we have seen yet.

As long as the POC is protected there is no danger to the uptrend.

The POC is 5761 in the NF and 11840 in the BNF.

Options/futures data for 13th Sep (EOD)

Monday, September 13, 2010

EOD Report for 13th SEPT

Open up outside of value and range and run higher.We know in Profile, whenever the market opens out of value and outside of range, there is a possibility of a large move in either direction.

With the markets accepting the gap-up within the first hour of the day, the possibility of a continuation move was higher than a fall back and re-test.

At one stage in the afternoon the quick launch from 5737 levels to 5777 levels was enough for adamant 5700 CE writers to start covering their positions.

We generally had seen the market and the global markets too to be bullish for this week, but the strength of that 40 point move even took me by surprise!

There have been enough adjectives to speak about the strength of the BN and by extension SBI. This index still has to give us a sweet spot for shorts to be placed on.

I'm sure quite a few of us took some shorts mid-day today, more out of disbelief in this big upmove than from any strong message for shorts coming from the market.

The message from the market is always very clear : above VWAP and Above value do not attempt shorts.Scalp trading is excused.

Sunday, September 12, 2010

Vtrender: This is who we are

Our methodology is called Market profile and to different people it can mean different things.

At Vtrender 2, we have started live market audio sessions to bring this wonderful concept closer to people.

This video below should give you a small preview to the world of Market profile as we understand it.

Enjoy !

Saturday, September 11, 2010

Open Interest & Nifty

- Call Option 5600-5800 added (9.4 lacs) OI with some unwinding seen at 5500 and lower strike price.

- Put Options 5400-5700 added (45.3 lacs) huge amount of OI with some profit booking seen at 5200 and lower strike prices.

- Highest accumulation on Call option can be seen at 5700 at 1.2 crore & 5600 at 1 crore whereas Put option 5400 at 1.3 crore & 5500 at 1.06 crore.

- Nifty Open Interest for September stands at 38214700 up by 1126650 with increase in Price (Long Buildup)

- Probable range as per option data for this expiry is 5550 to 5680

Thursday, September 9, 2010

What separates the 10% that make money from the 90% that don’t?

What separates the 10% that make money from the 90% that don’t?

10,000 hours.

In his recent book ‘Outliers’ Malcolm Gladwell describes the 10,000-Hour Rule, claiming that the key to success in any cognitively complex field is, to a large extent, a matter of practicing a specific task for a total of around 10,000 hours. 10,000 hours equates to around 4hrs a day for 10 years. For some reason most people that ‘try their hand’ at trading view it as a get rich quick scheme. That in a very short space of time, they will be able to turn $500 into $1 million! It is precisely this mindset that has resulted in the current economic mess, a bunch of 20-somethings being handed the red phone for financial weapons of mass destruction. The greatest traders understand that trading much like being a doctor, engineer or any other focused and technical endeavor requires time to develop and hone the skill set. Now you wouldn’t see a doctor performing open heart surgery after 3 months on a surgery simulator. Why would trading as a technical undertaking require less time?

Trading success, comes from screen time and experience, you have to put the hours in!

Education, education, education.

The old cliché touted by politicians when they can’t think of anything clever to say to their audience. The importance of education to success in trading cannot be placed on a high enough pedestal. You have to learn to earn, the best traders work obsessively to refine their edge further to stay ahead of the curve.

Think for yourself.

“NO! NO! NO!”… “Bear Stearns is not in trouble”…”Don’t move your money from Bear! That’s just silly! Don’t be silly!”

A quote from well known stock guru Jim Cramer aired on CNBC days before Bear Stearns lost 90% of its value. Many followed this call and felt the obvious pain as a result. As the old saying goes, “too many cooks spoil the broth” it is very much the same in trading. Successful traders blinker themselves from the opinions of others; they focus on their own analysis of fundamental and technical information.

Adapt or Die.

Market conditions change and technology advances, thus the conditions for trading are always evolving, the rise in mechanical trading is testament to that. The very best traders through a process of education and adaptation are constantly staying ahead of the curve and creating ever new and ingenious methods to profit from the markets evolution.

Fail to plan, you plan to fail.

The best traders have a well documented plan; they know exactly what they are looking for and follow that plan to the letter. Their preparation for a trade starts long before the market open, it is this meticulous planning and importantly adherence to that plan that helps them avoid the biggest demons for any trader, over trading and revenge trading.

“Be like Machine”

As human beings emotions pay a key role in our existence, for a trader emotions can be a source of great pain. Trading psychology and the management of your emotions in a trade play a key role in overall success. Fear and greed can cut your winners short and let your losers run. Dealing with emotions follows on from your plan; the more robust your plan the less likely you are to fall into the emotional mine field.

Know your tools

Every trader has a set of tools they use, DOM, Charts, News feeds etc. These tools are a traders bread and butter; they are the most vital part of a traders arsenal, without which it would be impossible to trade. The best traders have mastered their order entry methodology, they know all about the features they need from their charts. This mastery of their tools, allows the trader to get the very best out of the resources they have available to them and ensures perfect execution of their trading ideas.

Know Thyself

Behind all the egos and excess, the best traders know their limitations; they focus on what can go wrong in a trade, and expend a lot of energy in limiting and controlling their risk before thinking about profits. They have a heightened sense of self-awareness and focus on incremental self improvement.

Profit & Loss

The best traders focus on the trade itself rather than the P&L; they view each trade as a technical exercise and focus on getting the most out of the market in accordance with their plan. They do not think in terms of the grocery payment, the electric bill and the desire to make X amount to cover a mortgage payment. Focusing on the money behind a trade can cloud technical objectivity.

In Conclusion

The greatest traders work hard to get ahead and even harder to stay ahead. Through increased and niche knowledge they constantly adapt with the market and remain profitable in every environment. Drive, tenacity and the will to succeed is the greatest edge of every successful trader.

Harvesting profits from the financial markets - www.pivotfarm.com