Tuesday, October 25, 2011

Monday, October 24, 2011

Desi MO (McClellan's oscillator for NSE) at EOD 24th OCT 2011

Beginning November Series, the MO chart will be posted only when MO is approaching +60, -60 or is beyond these levels. Since MO is a broader market derived oscillator for overbought/oversold conditions, there is no point in publishing the charts when it is in flat territory! However for those who want to keep track of it, the current value of M.O. will be added in the comment section of the post.

Saturday, October 22, 2011

FnO Datasheet 21-10-2011

My notes:

- On a day when NF fell by 1%, FII bought 18K contracts in NF. With only 2 days to expiry, the buying makes things very interesting. Have they bought in October series or November Series? We have to wait for a couple of days to know.

- Friday has been another day where there has been significant rollover. There has been 32L OI reduction in October and 46L OI addition in November. Considering that NF has spent most of the day in the region 5050-5100 - there has been approximately 1 crore contracts rolled over in the price band of 5050-5150. For the next series, this price zone implies a very significant price band.

- Equity volumes continue to be on the lower end. FII sold 230 crore, DII bought 73 crore. So, as such the series continues to be played only on the FnO segment. The equities are getting used to produce the desired movement in the FnO segment.

- PCR has decreased from 1.06 to 0.94. This indicates higher activity on the Call segment - more calls being written at the various strikes. We are reaching the lower end of the PCR, be prepared for some activity on the Put writing soon.

- The option table has amateur bears written all over. Another 17L calls are written in 5000CE, 5100CE and 5200CE strikes. So, more than 50L contracts are written in the last 2 days in these 3 strikes. Looks, people are very confident that 5000 will be broken on the downside soon. It does not look like smart money which is writing these. For the last 3 days, FII are buying more options than writing them. Be prepared for a directional movement in the last 2 days.

- Looks, the bus offloaded some more people. The Call Writing at 5000CE when we are near 5100, indicates that bus is relatively less loaded. So, will it make the run now? Let us find out on Monday.

- Where do we go from here? Our SAR has reduced to 5032 from 5068 the earlier day. One interesting observation on Friday trading is ... Once NF went below 5068, it fell all the way to 5038 before recovering and closing at 5054. Considering the fact that FII net bought, have they bought near the lower end? We will know on Monday. The SAR is serving good purpose in the day trading.

- Considering that we are trading above 5014, the fairest price for the series, :) and Rm's Desi MO close to zero, a bullish rally might not be out of place.

- You can find the entire data sheet here.

Orderflow charts from last week

Here are the orderflow charts from last week.

These are for all the indices we track in the trading room including the MCX and NSE exchanges.

Bank Nifty :

Copper :

Crude :

Gold :

Nifty :

Silver :

The system generates buy and sell triggers which are used to initiate as well as reverse an existing position.

We recommend part booking of profits on our in house Prime Levels system which is modeled on the pivot point system of trading.

In the charts above, the buy sell triggers are given on twitter, as well as the part booking points are suggested to close a part of the trade in profit.

These are for all the indices we track in the trading room including the MCX and NSE exchanges.

Bank Nifty :

Copper :

Crude :

Gold :

Nifty :

Silver :

The system generates buy and sell triggers which are used to initiate as well as reverse an existing position.

We recommend part booking of profits on our in house Prime Levels system which is modeled on the pivot point system of trading.

For booking profits we have revisited

the age-old pivot point system of trading and worked on it by applying

principles of market profile especially volume profile.

Prime pivots explained :

The pivot point system works around the

pivot point which is calculated by five different methods, that I know

of. The system calculates the closing price, the high price and low

price of the day and in some cases even the open price and arrives at

the pivot point from where the remaining support and resistance levels

are derived.

What we found through our observations was :

a) The high price and the low price of

the day are usually areas of low volume, hence the system was biased

towards low volume trades.

b) The closing price is actually an

average price of the last 30 minutes of trade, and the relation of that

with the next day's activity wasn't very clear.

c) If the open price is taken in the

calculation it is also an area of low volume and in some cases odd ticks

and even false trades.

We flipped the system around to

arrive at a prime point zero or PP0 which is a combination of the

highest volumes traded at the Volume point of control and the price

point of control, serving us as some kind of a centre point for the

day.

We believe the market will be positive above this one number PP0 and attract buying efforts as long as it stays above it.Similarly it will be weaker below this PP0 level and attract selling efforts.

We also computed the Prime support (

PS1) and the Prime resistance ( PR1) about 70 % equidistant from this

PP0 or 35 % above it. The 70 % ( actually 68.3 %) number comes from our

computation of value area which is one standard deviation of price.

The remaining levels of Prime support 2 ( PS2) or Prime resistance 2 ( PR2) are calculated similarly.

The Prime Pivot system also called power

levels is a trading system in itself with a bias becoming strongly

positive as the market moves from PP0 to PR1 to PR2, PR3 etc.

Likewise the selling power increases from PP0 to PS1 to PS2, PS3 etc.

Friday, October 21, 2011

Thursday, October 20, 2011

FnO Datasheet 20-10-2011

I said yesterday that "the bus is getting crowded". Looks some off-loading happened today.

My notes:

My notes:

- FII have net sold 24K contracts today and their OI has increased by 19K contracts. So, most likely they have added some shorts.

- There has been 18L contract roll-over happened today. When you add 24L contracts rolled over yesterday, we have 42L contracts have been rolled over between 5050-5150 price zone. Considering that we are having around 2 crore OI on an average for the series, this is approximately 20%. So, this price zone will have a crucial bearing in the next series as well.

- Yesterday I have pointed to the abnormal addition of 5100PE. I further said that the rally can be easily manipulated as it is not backed up by equity volumes. You can see the effects today.

- We have opened today at 5098 and closed the day at 5103. So, it has been a scalpers day.

- In the equity segment, both FII and DII have been sellers. However, not in large volumes, but look just sufficient enough to induce the fall. :)

- The option table is providing an alternate color every day. There have been 42L calls written in 5000CE, 5100CE and 5200CE. Though 5100PE covered 10L contracts in the morning, during the recovery in the afternoon, entire volume has been written back. Those 42L calls do look like written in haste.

- FII have bought significantly more number of options than writing them today. It matches with our estimate yesterday that, a direction is round the corner. There are 2 possibilities of them buying options. The 13L contracts written at 4500PE is one and the 5000CE, 5100CE and 5200CE are the second. Either of them indicate that a direction is round the corner. :) I would be more biased to the Calls than Puts. For the Puts to come into money, we need a down circuit. :).

- Where do we go from here? Our OI SAR is at 5068. Yesterday the SAR was at 5106, we opened below that and promptly NF fell by 60 points. Let us continue to monitor this SAR.

- The complete datasheet is here.

OI and Volumes with vwap

Here are 2 end-of day charts of the Nifty and the Bank Nifty futures.

In the charts above you have daily candles of the current month's futures with the series vwap and the profile for the month in the top pane.

The pane below is the effective volume which is the net of the Volumes traded on the buy side as well as the sell side.

The pane below that has the Open Interest.

The last pane has the volumes for the day.

In the Nifty the fairest price is at 5014 thus far and the series vwap is at 4982. We will continue monitoring that into expiry.

In the BankNifty the fairest price is at 9600 about the series vwap is at 9323.

Wednesday, October 19, 2011

FnO Datasheet 19-10-2011

My notes:

- We have a 2% rally on NF, almost breaking the perceived trading zone. This is the 4th closing above 5110 in the last six trading days. Everyone in the trading room knows the importance of 5110. :) Will this be a sufficient requirement for us to proceed to the conquering the all important 5200? Let us see.

- Shorts really ran for cover today. 12L contracts in NF have been covered today. I remember one of the early lessons in the trading room by Shai - "Short covering leads to a price rise. But, it weakens the market internally." I do not see much buying happening. So, is market structure weakening? We will know in the next 2 days.

- Though FII have bought 10K contracts, their OI has increased only by 4K contracts. So, we have to assume that, they have covered shorts of 6K contracts. Now, NF has reduced OI by 12L contracts. So, FII could obtain a short covering of 12L contracts for their 6K contract short covering. Amazing leverage. :) Leaving jokes apart, I feel that, there is a serious mismatch between the FII and the other traders on the direction of Future of Nifty Future. :) Who has more chances of being right? Take your call.

- Turning to equities springs another surprise. For a rally of 100 points on NF, both the FII and DII turned out to be sellers in the equity segment. That indicates that, this rally is done via short covering only and ... is limited to FnO segment.

- The option table paints a bullish picture. Lot of call covering at different strikes, and mammoth put writing. The most interesting part is the put writing at 5100 and call covering at 5000. 5000CE covered approximately 10L contracts. There has been a writing of 6L contracts at 5300CE. So, bears are not confident that 5200 also can hold the bull rally. For me the defining part is 24L contracts being written in 5100PE. If we look into the last 3 days, each day 5100PE has been the focus. Yesterday, after covering 18L contracts, it looks the bulls are back with a vengeance. Is their bullishness justified? Looks a lot of people are playing for a Diwali rally.

- The troubling part for me, is in the correlation between the option table and the Institution data. The data sheet shows that, FII bought more options today than writing them. It is perfectly plausible to opine that, their option buying has to do with 5000CE and they are covering their loss. However, the other alternative is if they are buying the 5100PE. We will soon know.

- Where do we go from here? Our SAR number is at 5106 - quite close to Vinod's 5110. Stay long above it - and stay short below it. It is working quite well.

- It is alright to play for the Diwali rally - historically, it is a proven thumb rule. However, remember that the bus is getting crowded. Additionally, it is important to remember that, we are in the midst of a rally, which is only happening in the FnO segment. There is no corresponding equity buying at all.

- The complete datasheet is here.

FnO Datasheet 18-10-2011

My notes:

- On the last day of September expiry, NF closed @ 5030 and FII had an OI of 5.09L. On 18th Oct, with 5 days left for expiry, we have NF closing at 5044 and FII have an OI of 5.43L. Add to that NF had an OI of 1.934 crore and on 18th Oct, NF OI was 1.945 crore - a difference of 10L contracts. In between, 25L contracts entered and exited hoping for a directional movement. All in all, a month where nothing happened so far.

- Even on the equity front, if we take out the 2300 crore sale by FII and 1200 crore buy by DII in the last series last days, nothing significant happened. All in all 1000 crore selling by FII and 700 crore buying by DII in this series of 13 trading days so far.

- The stand out number in the entire series is the VIX. From highs of 35, it fell to 25. So, it has been a month of option writers. At VTrender, most of us wrote options on either side in the first 2 days of the series.

- As Girish quotes regularly in the trading room, retail traders lose money by looking for a trending move in non-trending environments and staying out in trending environments. You can see evidence of that in the 10L shorts exiting on 13th Oct and 17L longs exiting on 18th Oct. So far the month has been a low volume, directionless and option writer friendly month. Direction might be round the corner.

- The option table data indicates decent support at 4800 and reasonable resistance at 5200. OI covering at both the strikes today, indicating that a directional movement is round the corner. I am guessing that we will have an expiry at one of those two strikes.

- Where do we go from here? The SAR number that we have been using, which is the average price of OI contracts of FII is at 4996. I continue to believe this number, and it is prudent to stay long above this number and short below it.

- Most of you might be expecting a Diwali rally. But as RM says in the trading room, it is always the minority which wins in the markets. So, be open for possibilities. My take on this month is ... an absolute neutral month with no bias. But, it will be forcefully bent to one direction by the institutional players in the last 5 days so that maximum damage can be caused to maximum players. So... As the Jedi says "May The Force Be With You" :)

- You can find the entire datasheet here.

Tuesday, October 18, 2011

Monday, October 17, 2011

OF and MP 2

This is a continuation from my last post on the subject : http://www.vtrender.com/2011/10/of-and-mp.html

This morning Market profile helped us set up an easy 80 % rule trade.

This is the definition :

" If a market opens above (below) value area and crosses value high (low) , then in 80 % cases it will go on to hit the Value area low for that day.

Have a look :

The value area High is shown as VAH in the chart and the value area low is shown as VAL.

Just to confirm we had a sell signal in the OrderFlow charts,

At the moment ( 1.00 pm IST) the value area low is also the low of the day.

The pull back from the day high has measured 81 points in keeping with the post we made on the weekend.

This morning Market profile helped us set up an easy 80 % rule trade.

This is the definition :

" If a market opens above (below) value area and crosses value high (low) , then in 80 % cases it will go on to hit the Value area low for that day.

Have a look :

The value area High is shown as VAH in the chart and the value area low is shown as VAL.

Just to confirm we had a sell signal in the OrderFlow charts,

At the moment ( 1.00 pm IST) the value area low is also the low of the day.

The pull back from the day high has measured 81 points in keeping with the post we made on the weekend.

Saturday, October 15, 2011

Nf Profile check

On Thursday the market attempted to auction lower in the afternoon session after it had met with resistance around 5130 levels and was managing to clear the anomalies mentioned in our blog post that day.

The auction however had lower volumes than the preceding day and was an indication that the market wasn't really ready to break. Don't confuse that with strength however.

We spoke about an acceptance above 5062 as a new bracket, and the lows were in that zone.

As we look at the new week from Monday, let's look at the bigger bracket on the Nifty daily chart.

The above chart is that of the Nifty spot. It clearly shows the market approaching the upper end of the bracket ( in blue).

Trade location will be important at the start of the week. There could be traders pushing the market higher to trigger stops which are likely to be heavy in the two zones pointed out.

There could be new buyers, just as easily as new sellers would be waiting to enter at these levels again.

In the Trading room, following OrderFlow as a basis for taking the calls becomes vitally important. Blue and green to support will signal new buyers and red and pink will speak about sellers wanting to come back.

We also need to keep an eye on the reaction theory playing out within the bracket.

The auction however had lower volumes than the preceding day and was an indication that the market wasn't really ready to break. Don't confuse that with strength however.

We spoke about an acceptance above 5062 as a new bracket, and the lows were in that zone.

As we look at the new week from Monday, let's look at the bigger bracket on the Nifty daily chart.

The above chart is that of the Nifty spot. It clearly shows the market approaching the upper end of the bracket ( in blue).

Trade location will be important at the start of the week. There could be traders pushing the market higher to trigger stops which are likely to be heavy in the two zones pointed out.

There could be new buyers, just as easily as new sellers would be waiting to enter at these levels again.

In the Trading room, following OrderFlow as a basis for taking the calls becomes vitally important. Blue and green to support will signal new buyers and red and pink will speak about sellers wanting to come back.

We also need to keep an eye on the reaction theory playing out within the bracket.

The above chart is a 30 minute reaction chart showing the activity of buyers and sellers.We spoke about reaction theory in our post last on Tuesday in this post

In this market which is trending up we have seen three major reactions, measuring 60 points, 86 points and 75 points respectively.Yesterday's intra day reversal measured 38 points.

From the highest point of the coming week, if we see a bigger reaction than the ones we have noted above, then the pendulum would have truly shifted from the buyer to the seller in the coming week.

Friday, October 14, 2011

NF Profile

Here is the updated profile chart form yesterday with some observations on it.

This chart is posted on Vtrender- 2 every evening after the market closes.

Some other observations about yesterday's auction :

Thursday's charts :

1) A normal variation day with bias going to the seller for day time control.

2) Auction still at the upper end of the previous 4900-5060 bracket.

3) A balanced profile to describe the day

4) the balanced profile breakout can project a 180 point move

5) exit of range n value is the better trading approach.

This chart is posted on Vtrender- 2 every evening after the market closes.

Some other observations about yesterday's auction :

Thursday's charts :

1) A normal variation day with bias going to the seller for day time control.

2) Auction still at the upper end of the previous 4900-5060 bracket.

3) A balanced profile to describe the day

4) the balanced profile breakout can project a 180 point move

5) exit of range n value is the better trading approach.

Thursday, October 13, 2011

OF and MP

I'm going to post a series of articles showing the correlation of OrderFlow with Market Profile.

Here is the first one from last afternoon to today.

As you know we were tracking a bracket high at 5060 and a break above it was a buy signal.

After the close we posted this chart on Vtrender-2 for our premium subscribers, which talked about a spike into the close and anomalies at 5094 and 5074.

Take a look :

These were the observations on the day's auction which were posted at 5.30 pm last night.

Wednesday's charts :

1) A neutral day in NF with a FA below and close at extreme

2) Upper profile is non- symmetrical and having anomalies, which means that it will be revisited

3) Acceptance above day high is however bullish

4) Resistance above is 5151 and then 5235

5) Staying above 5062, the previous bracket high will mean that a new range will develop.

6) FA at 5001 will be revisited between 1-5 days

7) An auction below 5000 will change the trend to lower.

Expecting a revisit into this zone at the top of yesterday's profile and an auction to create symmetry.

Here is the first one from last afternoon to today.

As you know we were tracking a bracket high at 5060 and a break above it was a buy signal.

After the close we posted this chart on Vtrender-2 for our premium subscribers, which talked about a spike into the close and anomalies at 5094 and 5074.

Take a look :

These were the observations on the day's auction which were posted at 5.30 pm last night.

Wednesday's charts :

1) A neutral day in NF with a FA below and close at extreme

2) Upper profile is non- symmetrical and having anomalies, which means that it will be revisited

3) Acceptance above day high is however bullish

4) Resistance above is 5151 and then 5235

5) Staying above 5062, the previous bracket high will mean that a new range will develop.

6) FA at 5001 will be revisited between 1-5 days

7) An auction below 5000 will change the trend to lower.

Expecting a revisit into this zone at the top of yesterday's profile and an auction to create symmetry.

Wednesday, October 12, 2011

Tuesday, October 11, 2011

Nf Today

Target done. Now what?

At the time of this post the NF is still in the Initial Balance or the first 60 minutes of the day's action.

We have a gap at the open which is not yet covered.

The NF maintains itself in the smaller 4904- 5060 bracket within the larger 4725- 5233 bracket.

There is a gap below the smaller 4904- 5060 bracket and a gap above it also .

Using reaction theory we can easily measure who has greater control within this smaller bracket.

Reaction theory of Market profile is nothing but the amount of market movement created by buyers or sellers.

Within this smaller bracket we had a reaction measuring 35 points yesterday in the afternoon which took the market from 4974 to 4940 which was the day vwap and from where the dominant party took control again.

We also measure that level as the pull back low, as shown in the chart.

The other slightly bigger reaction was from 4937 to 4773 on Friday which took the market down 64 points.

So a reaction of 35 points from the day high will put the market at or near 5020 in the futures.

Anything beyond this, will in all probability put the market near 4990 which is near the target end for a normal variation day with a 2IB target.

At the time of this post the NF is still in the Initial Balance or the first 60 minutes of the day's action.

We have a gap at the open which is not yet covered.

The NF maintains itself in the smaller 4904- 5060 bracket within the larger 4725- 5233 bracket.

There is a gap below the smaller 4904- 5060 bracket and a gap above it also .

Using reaction theory we can easily measure who has greater control within this smaller bracket.

Reaction theory of Market profile is nothing but the amount of market movement created by buyers or sellers.

Within this smaller bracket we had a reaction measuring 35 points yesterday in the afternoon which took the market from 4974 to 4940 which was the day vwap and from where the dominant party took control again.

We also measure that level as the pull back low, as shown in the chart.

The other slightly bigger reaction was from 4937 to 4773 on Friday which took the market down 64 points.

So a reaction of 35 points from the day high will put the market at or near 5020 in the futures.

Anything beyond this, will in all probability put the market near 4990 which is near the target end for a normal variation day with a 2IB target.

Monday, October 10, 2011

NF & BN of Today

We reversed our overnight shorts in NF and BN in the opening session and saw it print it's way to good profits during the day.

NF:

When we track Orderflow, it is very important to note down the levels at which the buyers and the sellers show up and their influence around the same.

Today's buyer was at the same point as Friday and will be an important reference point in the sessions to come.

BN :

The same picture in the BN chart as well.

In the profile chart, after the consolidation and the balanced profile of Friday, a big move was on the cards once we broke value and range.,

Have a look at the chart below :

Two things are clearly visible in the chart :

1) an entry into the previous smaller bracket as shown in the smaller blue rectangle. A bracket is considered a larger value area and once it enters this zone it can move right through it , similar to the 80 % rule we track during intra day

2) The balanced profile of Friday, projected a move back to the day's Point of Control ( POC) and a trending move to begin from there which should have gone past the day's value area and range.

All the above happened. the buyer was due.

NF:

When we track Orderflow, it is very important to note down the levels at which the buyers and the sellers show up and their influence around the same.

Today's buyer was at the same point as Friday and will be an important reference point in the sessions to come.

BN :

The same picture in the BN chart as well.

In the profile chart, after the consolidation and the balanced profile of Friday, a big move was on the cards once we broke value and range.,

Have a look at the chart below :

Two things are clearly visible in the chart :

1) an entry into the previous smaller bracket as shown in the smaller blue rectangle. A bracket is considered a larger value area and once it enters this zone it can move right through it , similar to the 80 % rule we track during intra day

2) The balanced profile of Friday, projected a move back to the day's Point of Control ( POC) and a trending move to begin from there which should have gone past the day's value area and range.

All the above happened. the buyer was due.

FnO Datasheet 07-10-2011

The series is 10 days old. As I could not post the daily views for the series, I am giving my observations on the whole series so far. We will continue with daily notes from tomorrow. My notes:

- I have updated the data sheet to reflect the OI changes from 23rd September, for the October series. On 23rd September, the OI was at 50L. So, from now on we will start observing a series a bit early to note down the roll-over price.

- October series had a maximum roll-overs of around 1 crore contracts ( 50% of present) between 27th, 28th and 29th. The NF was trading in the range between 4950-5030. Whenever, the price band is approached, expect some violent reactions. When we broke it on the downside, we made 200 points very fast. Though, we made a rally on Friday, it looks more of a short covering rally than greens entering the series. So, the theme is ... watch out for the reactions at 4950-5030. Ideally stay short below 4950 and stay long above 5030. Any existing shorts probably can use 5030 as the stop loss.

- Though volumes for the entire week are on the lower side, Friday's volumes attract attention. FII have bought 65K contracts. However, equally perplexing is the observation on OI. It remained unchanged. NF closed around 4900, so let us wait for another 50 point rally and consider the reactions there.

- Equity volumes are one significant factor in the series so far. What is most notable is the continuous selling by FII on reasonably high volumes. FII have sold around 3000 crore equities so far this month (counting from starting of this series.) Out of which only 1500 crore has been bought by DII. So, the remaining 1500 crore is bought by retail. FII withdrawal from equities is not a good sign for bull - all the more - when we consider that most of the selling is absorbed by retails - rather than DII.

- On the last day of the September series, FII have an OI of 5L contracts and NF has OI at 2 crore contracts - so this OI 99% belongs to this series. We are still around the same mark - 10 days into the series. Let us watch how it develops this week.

- The SAR number we have been observing, the net contract value of the OI is at 4838 now. So, if one wishes to play on the long side, greens can be bought at a price close to that with Stop Loss at 4838. Let us continue observing the number.

- One other concerning factor for me is high PCR. PCR at 1.28 indicates a value in the higher range. 0.9-1.3 is the normal range - and I have observed that below 0.9 attracted a rally and above 1.3 attracted a fall. Let us observe how things unfold.

- In the option table, the activity at 4300PE and 4400PE is interesting. 4300PE has 12L OI covering where as 4400PE has equal addition. So, may be bull confidence which shifted the lower end of spectrum one notch higher. Let us see.

- You can find the entire datasheet here.

Saturday, October 8, 2011

Weekend Musings

As we move further into this bear market, we are going to be witness to changing conditions not just of our own local market movements but from others as well.

This was projected yet again through the big gap open on Friday, a condition not generated by our own dealings. We tried to be ready through a study of the Euro, Dollar and the Spx which we did ahead of the Holiday in this post here, each of which went as expected to the given targets.

Bear markets are a continual battle between deteriorating fundamentals and the governments attempts to abort the cleansing process. That is the scenario for very difficult trading conditions.In 2008 even though our market was not as affected, the liquidity pump given to industry is now showing it's ugly head in run-away inflation which the RBI is having a difficult time to manage.

The news from Spain and Italy and the Fitch downgrades reversed a tear away rally which 3 days earlier had reversed a water fall like decline!

In such markets one has to be willing to reverse positions quickly, because fundamental perceptions can change fast and profits evaporate.

Unless someone had inside information that the downgrade was coming there’s just no way to predict these kind of things. And the same thing can happen on the downside. The Fed can abort almost any leg down with just a hint that they might fire up the printing presses. This is the recipe for a very volatile and whipsawing type market.

For the next 12 months at least, I foresee a dogfight for every little profit.Indeed if you are not emotionally equipped to handle this kind of trading environment, I suggest waiting on the sidelines as somebody once famously said "cash is a position".

To trade successfully in such markets, one needs to have an excellent trading system which can quickly identify the changing moods of the markets.No system is fool proof and nobody is going to get a 100 % of their trades right, but proper and timely execution can prevent losses if not generate out right profits!

Secondly, these markets cannot be traded in a vacuum. You need the support of a trading community to point out not just various pieces of news, but also price discovery and direction. Indeed in volatile markets, it is not possible to store up large amounts of information from the markets and a helpful guiding community can go a long way in ensuring that you are on the right track in such markets.

At Vtrender we take great pride in knowing that we have to a large extent tried to cover both the above mentioned attributes through the OrderFlow system and then the Trading community in the Trading room.

In OrderFlow we have an excellent system of trading which will always put us ahead of the various turns this market will take as it rides out this bear market. The instrument does not matter. the system works in all markets across stocks, commodities and currencies.

Take a Look :

Bank Nifty :

Gold :

Silver :

Those are the OrderFlow charts for this week gone by.

They ensured that our week was profitable regardless of the down then up movement of the market.

In our small community at Vtrender Live in the trading room, we are increasingly getting to hear very good views on both sides of the market. Indeed like lawyers coming to a courtroom, arguments are being made for both sides of the market, with the final market judgment accepted as supreme.

As the saying goes : "Believe in the market, not the experts in the market"

Happy weekend.

This was projected yet again through the big gap open on Friday, a condition not generated by our own dealings. We tried to be ready through a study of the Euro, Dollar and the Spx which we did ahead of the Holiday in this post here, each of which went as expected to the given targets.

Bear markets are a continual battle between deteriorating fundamentals and the governments attempts to abort the cleansing process. That is the scenario for very difficult trading conditions.In 2008 even though our market was not as affected, the liquidity pump given to industry is now showing it's ugly head in run-away inflation which the RBI is having a difficult time to manage.

The news from Spain and Italy and the Fitch downgrades reversed a tear away rally which 3 days earlier had reversed a water fall like decline!

In such markets one has to be willing to reverse positions quickly, because fundamental perceptions can change fast and profits evaporate.

Unless someone had inside information that the downgrade was coming there’s just no way to predict these kind of things. And the same thing can happen on the downside. The Fed can abort almost any leg down with just a hint that they might fire up the printing presses. This is the recipe for a very volatile and whipsawing type market.

For the next 12 months at least, I foresee a dogfight for every little profit.Indeed if you are not emotionally equipped to handle this kind of trading environment, I suggest waiting on the sidelines as somebody once famously said "cash is a position".

To trade successfully in such markets, one needs to have an excellent trading system which can quickly identify the changing moods of the markets.No system is fool proof and nobody is going to get a 100 % of their trades right, but proper and timely execution can prevent losses if not generate out right profits!

Secondly, these markets cannot be traded in a vacuum. You need the support of a trading community to point out not just various pieces of news, but also price discovery and direction. Indeed in volatile markets, it is not possible to store up large amounts of information from the markets and a helpful guiding community can go a long way in ensuring that you are on the right track in such markets.

At Vtrender we take great pride in knowing that we have to a large extent tried to cover both the above mentioned attributes through the OrderFlow system and then the Trading community in the Trading room.

In OrderFlow we have an excellent system of trading which will always put us ahead of the various turns this market will take as it rides out this bear market. The instrument does not matter. the system works in all markets across stocks, commodities and currencies.

Take a Look :

Bank Nifty :

Gold :

Silver :

Those are the OrderFlow charts for this week gone by.

They ensured that our week was profitable regardless of the down then up movement of the market.

In our small community at Vtrender Live in the trading room, we are increasingly getting to hear very good views on both sides of the market. Indeed like lawyers coming to a courtroom, arguments are being made for both sides of the market, with the final market judgment accepted as supreme.

As the saying goes : "Believe in the market, not the experts in the market"

Happy weekend.

Friday, October 7, 2011

Thursday, October 6, 2011

Longer duration profiles

Here are some longer duration profile charts

From Right to left, profiles show a 2 year, one year, 3 month and a one month profile.

Notice the point of control moving lower consistent with the selling seen in the markets.

Longer term investors should pay attention to the value areas to confirm longer term investments, should the market provide investment opportunities.

The value areas are in green and the point of control is in red.

From Right to left, profiles show a 2 year, one year, 3 month and a one month profile.

Notice the point of control moving lower consistent with the selling seen in the markets.

Longer term investors should pay attention to the value areas to confirm longer term investments, should the market provide investment opportunities.

The value areas are in green and the point of control is in red.

Wednesday, October 5, 2011

Holiday ahead

As the NSE prepares to close it's afternoon session, it has to factor in 2 closings on the spx and another 2 on the European bourses.

Considering the kind of climate we are in , it's not an easy job.

The last 2 days in the US markets have provided swings of 45 points each, and if there is one time frame movement any one way, then those markets could be up 100 points up or down!!

This past weekend I could not post a chart of the US dollar. Here it is :

We spoke of a move to 80.5. The dollar index tagged 80.43 before retreating.

79.4 and 78.9 will keep that uptrend intact, before it finally takes out 81.

Here is a daily chart of the euro to confirm the view.

There is small Short term support in the 1.315 zone, but sellers will be back around the 1.35 region.

Finally the spx futures :

After the reversal off the aug lows, this market looks like headed for 1127.

Strength above 1127 will keep the whipsawing moves and the range still alive.

We are seeing the same in the NF late afternoon yesterday and early this morning.

This chart was posted at vtrender-2 last night. :

The current auction is in the centre of yesterday's double distribution in the entire single prints of the DD

Let's see whether it resolves to the upper or lower side this afternoon.

Considering the kind of climate we are in , it's not an easy job.

The last 2 days in the US markets have provided swings of 45 points each, and if there is one time frame movement any one way, then those markets could be up 100 points up or down!!

This past weekend I could not post a chart of the US dollar. Here it is :

We spoke of a move to 80.5. The dollar index tagged 80.43 before retreating.

79.4 and 78.9 will keep that uptrend intact, before it finally takes out 81.

Here is a daily chart of the euro to confirm the view.

There is small Short term support in the 1.315 zone, but sellers will be back around the 1.35 region.

Finally the spx futures :

After the reversal off the aug lows, this market looks like headed for 1127.

Strength above 1127 will keep the whipsawing moves and the range still alive.

We are seeing the same in the NF late afternoon yesterday and early this morning.

This chart was posted at vtrender-2 last night. :

The current auction is in the centre of yesterday's double distribution in the entire single prints of the DD

Let's see whether it resolves to the upper or lower side this afternoon.

Tuesday, October 4, 2011

Monday, October 3, 2011

Sunday, October 2, 2011

75 weekly

One of our readers mailed me a chart showing the 75 week moving average.

I reproduce the chart for you.

I'm not a big fan of moving averages for shorter term trading, their utility lies in identifying trends.

However the 75 week moving average has long been considered a dividing line between bull and bear markets.

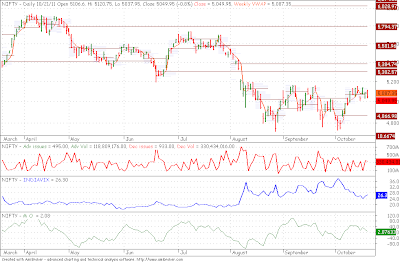

The above chart shows a 75 week average against a weekly chart of the Nifty spot.

Besides the average what I found interesting was the pattern developing in September 2008 against this one in 2011.

My time cycle counts put us in a new intermediate cycle which should be in week 2 by now. The cycle projects a consistent range of 1000 points for a quarter, which means that should we not fill that gap between 5060 and 5110 we should be forming a left translated cycle which should take us to 42xx by the year end.

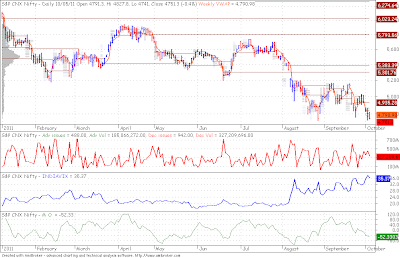

Back to the subject of the 75 weekly, let me put up one more chart :

This is the USD chart at the 75 weekly.Clearly shows that it still has to overcome it to be considered a bull market.Once this chart starts moving northwards, equities should begin a waterfall type decline.

A shorter duration chart of the USD futures ( not uploaded here) , shows that should the dollar penetrate 79 early next week, it should have an easy ride to 80.5 and 81 which means that stocks the world over will be under a lot of pressure through the week.

I reproduce the chart for you.

I'm not a big fan of moving averages for shorter term trading, their utility lies in identifying trends.

However the 75 week moving average has long been considered a dividing line between bull and bear markets.

The above chart shows a 75 week average against a weekly chart of the Nifty spot.

Besides the average what I found interesting was the pattern developing in September 2008 against this one in 2011.

My time cycle counts put us in a new intermediate cycle which should be in week 2 by now. The cycle projects a consistent range of 1000 points for a quarter, which means that should we not fill that gap between 5060 and 5110 we should be forming a left translated cycle which should take us to 42xx by the year end.

Back to the subject of the 75 weekly, let me put up one more chart :

This is the USD chart at the 75 weekly.Clearly shows that it still has to overcome it to be considered a bull market.Once this chart starts moving northwards, equities should begin a waterfall type decline.

A shorter duration chart of the USD futures ( not uploaded here) , shows that should the dollar penetrate 79 early next week, it should have an easy ride to 80.5 and 81 which means that stocks the world over will be under a lot of pressure through the week.

Subscribe to:

Posts (Atom)