Friday, December 10, 2010

Options/futures data for 9th Dec (EOD)

Summary:

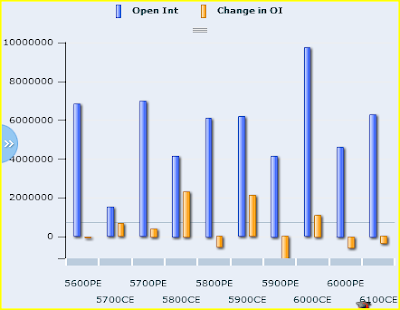

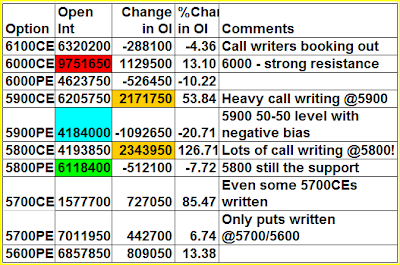

1. Options table gets a 'sad makeover' with some rows eliminated above 6000 and rows added at 5700/5600 - which means all is not well with market's health! The story of the day was massive call writing @5800/5900 strikes and decent amount of put covering @5900/5800 - resembling rampaging bears that too on Steroids and not eating Cadbury's Gems, like we are used to seeing on TV

2. 6000 now upgraded to strong resistance. Almost 1Crore calls @any strike so early in a series is scary to say the least.

3. 5900 is still a 50-50 level with negative bias (may get upgraded to resistance tomorrow if 10L more calls get added and 10L puts cover).

4. 5800 is still the support - but the act of 23L call addition @5800 gives the impression that some serious work is being done by bears to capture it.

5. PCR has been smashed from 1.14 to 1.05 - entering a level from where we have seen some temporary pull backs during Nov expiry week

Nifty Futures:

2.68Cr OI up 1.3% (3.6L shares added) - still not massive amount of shorts. I presume these were dip buyers?

Banknifty Futures:

12.5L OI down 6.7% (0.9L shares cut) - 80% of shorts added in previous 3 days are covered!

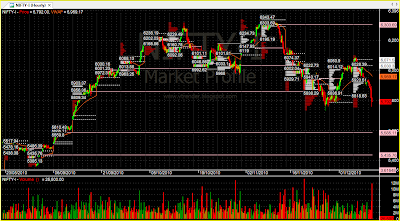

Nifty Weekly chart - showing not much support below 5730. The next one comes in close to 5585-5600

Subscribe to:

Post Comments (Atom)

2 comments:

11600-11440-11300

5890-5780-5770

are the values for today.

McClellan reads -80.

new post

Post a Comment