Summary:

1. Looking at options data on Friday, all I can say is that - option writers these days have become totally 'fickle minded'. With everyone following the herd (trend) like Sheep, we are having these 'RISK ON' and 'RISK OFF' days more often. The concept of trend used to be measured in months/weeks and now it seems that in less than one week we can have a trend and a trend reversal too. And looking at Banknifty, a trend can truly be measured in matter of hours!2. Its very good that one of the readers of this blog 'alphabet1' commented about the weird activity @6000. I too found it interesting and dug in deeper into the 6000PE. Attached is last 15 day's action in 6000PE

Note that in 4 sessions when Nifty Fut crossed 5970 and stayed in the range of 5970-6090, 26L 6000PEs were added and in next 3 sessions when Nifty Fut tanked below 5970 till 5750s and reversed till 5890, 24L of those puts were unwound. Lets now look at the story with 6000CEs

When NF fell from from 5970 to 5760, 25.8L calls were added and on Friday 20.8L calls were covered.

What can we conclude? As of now Nifty is back to the same situation where it was in the middle of last week. But if one gives priority to 'momentum' (NF rise, 5900 & 6000CE covering), it can be assumed that the market wants to move higher and hence the eagerness of call writers to cover. For this assumption to be validated, we need follow up action - NF rise, further call covering at 6000/5900/5800 and put writing at those strikes. Till then 6000 is officially a resistance.

3. 5900 is still a 50-50 level but now with a positive bias due to the massive call covering on Friday

4. Some more observations:

i) 5800CEs added 23L on Thursday and not a single one has covered yet. Are these Covered calls?

ii) This market seems to like 'Pig with lipstick' analogy. This time its in a reverse sense! Like we saw in early November there were more 6300PEs compared to 6200PEs and market fell badly - this time the story is opposite. There are more calls only at one strike which is 6000. And in last few sessions 6100/6200/6300CEs are quietly unwinding and keeping the lipstick @6000. No prizes for guessing what could happen!

iii) Food for thought: Despite the big rally from 5400+ to 6300, not even a single expiry has happened above high 6000s. Last 3 expiries were @6029, 5987, 5799. So call writers @6000/6100/6200/6300 have enjoyed free money for last 3 months. Do unusually good times last forever?

5. PCR took a U-turn and jumped from 1.05 to 1.13

Nifty Futures:

2.5Cr OI down almost 7% - 18.5L shares cut!! And this massive short covering has resulted in Nifty Fut OI going back to exactly the level seen at end of Black Friday (Nov 26th)

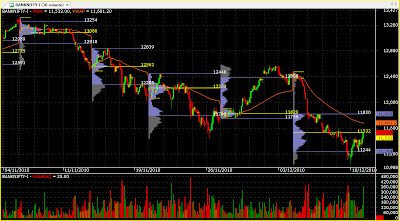

Banknifty Futures:

12.4L OI down 1% - All of the shorts initiated from 12500 levels since last Monday (6th Dec) are covered in last 2 days!

Weekly Charts:

On weekly timeframe, NF if holds the VAL @5819 (well you need to give another 20-25 pts for inaccuracy in Amibroker/data feed values and volatility) and crosses last week's breakdown region of 5940-5970 then a trip to 6005-6037 is definitely possible

5 comments:

Excellent analysis Girish, thanks!

Good Morning Girish,

None could have put it better than this.

Thank You for all the effort.

Do we have a Christmas rally coming ?

http://www.youtube.com/watch?v=ihW56Xa3XGQ&NR=1

No idea alphabet1.

These option writers are changing their stakes every day. Only a follow up action will confirm the rise.

The defining point as one can easily guess 6050-6090-6124 NF. If these are taken out along with covering of 5900/6000CEs then there could be a rise back to 6200+ for end of December.

As I mentioned in the original post, these days trends are lasting less than a week. So we have to take every week as it unfolds.

on friday when the writers were doing their stuff at 6000, the CE writers at 6000 Jan did not reduce.

always the bigger TF wins.

new post

Post a Comment