Tuesday, December 28, 2010

Options/futures data for 27th Dec (EOD)

Summary:

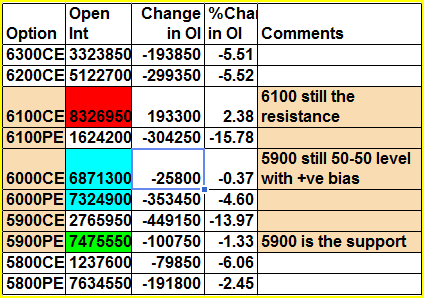

1. Not much happened in market yesterday and not much happened in Options world either. The range suggested by options for expiry is still 5900-6100

2. 6100 is the resistance. Some amount of put covering happened @6100 but that was not significant

3. 6000 is still a 50-50 level with +ve bias and 5900 is the strong support.

4. Not much change in PCR either - up from 1.41 to 1.42

Nifty Futures:

2Cr OI down 5.8% (12L shares cut)

78L OI up 14% (10L shares added) -- 20% less rollover to Jan

Banknifty:

11.9L OI down 2.8% (0.35L shares cut)

5.2L OI up 43% (1.6L shares added) -- yet another day of blockbuster OI addition in Jan futures of Banknifty! As of now I am assuming these are longs in Jan futures. A move below 11330-11200 with more OI addition will invalidate that assumption.

Subscribe to:

Post Comments (Atom)

1 comments:

Thanks Girish!

Post a Comment