Monday, December 6, 2010

Options/futures data for 3rd Dec (EOD)

Summary:

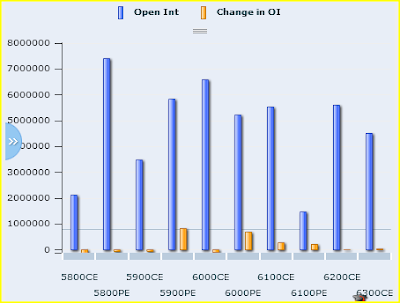

1. Even on Friday, the options table continued to repeat the same story of 'large number of puts added @lower levels & small amount of calls added at higher levels'

2. With 52L puts vs 66L calls 6000 (although officially a resistance) now gets close to a 50-50 level.

3. 5900 now becomes an intermediate support with strong support at 5800

4. Interestingly 6100CE OI (55L) as of now is less than 6000CE OI (66L). So if 6000CEs are forced to cover, a swift rise is possible from here.

5. PCR slightly up from 1.24 to 1.26

Nifty Futures:

2.7Cr OI down 0.4% (1L shares cut from OI) - OI still has net longs added from sub 5800/5900 levels

Banknifty Futures:

12.3L OI down 1.2% (0.14L shares cut) - OI effectively down 14% in last 4 trading sessions

Subscribe to:

Post Comments (Atom)

5 comments:

mmm manu is right, u r posting even when bzy

:)

thanks

Thanks Girish!

Moh - Once a trader always a trader :)

Thanks Girish.

All eyes on the 6000 CE then.

Yes Viren. 6000CE unwinding will send this market very fast to 6100+

Post a Comment