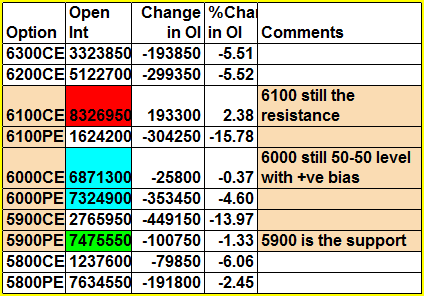

1. Well, the markets have gone nowhere in the last few days and not much updates to options table either. The range still remains 5900-6100 for expiry. The only folks who are smiling are the 6000 Short Straddle writers for December. What's interesting though is 5900CEs are unwinding very fast - almost 10-12L unwound in last 3 days. Do these writers expect an expiry close to 6100?? Even the 5800CEs have vanished quite a bit when this market has been going nowhere.

2. 6100 still the resistance with 83L calls vs 16L puts

3. 6000 is a 50-50 level with positive bias due to higher puts vs calls

4. 5900 is the strong support

5. PCR going up from 1.41 to 1.46 - doesn't have much significance now.

Nifty Futures:

1.87Cr OI down 6% (13.5L shares cut)

0.97Cr OI up 24% (19L shares added) -- Almost 50% new OI added to Jan futures with decent premium.

Banknifty Futures:

10L OI down 15% (1.85L shares cut)

9.5L OI up 80% (4.2L shares added) -- Again a large OI increase in Banknifty futures for Jan. I went back and checked the OI build up in next series during Oct/Nov expiries and it looks like a similar build up had happened. All I can say is a directional move does come after such build up. So keep an eye on the all important levels 11570 first and then 11680 on the upside. On the downside 11410-11370-11330 would be on watch for next few days. And remember - "Open Interest never lies" - because its got real money involved!

10 comments:

Thanks Girish!

is NF in overbought zone? can we see 15-20 pts drop tom. morning?

Good eve, Girish,

Will you post todays Banknifty(Yellow/pink, Red/blue) ORDER FLOW charts.

Thanks.

Janak,

Not sure man. Actually I saw that by end of day, DPOC was close to highs of the day. Because there was no QT charts in the trading room, I am not able to confirm. Will check my data feed after backfill tonight and get back to you.

Besides expiry day will have its share of up-down swings for sure.

Another reason to expect some down swing is -- having been in profits all this month, the 6000CE writers may not meekly submit tomorrow.

Abhishek,

Sorry man. Shai/Viren are the folks who maintain all the stuff in trading room. I am just a subscriber who also likes to post on Futures/Options data.

I will post the monthly charts in tomorrow morning's post

@Girish

The DPOC is not close to the high of the day in Amibroker MP charts.

BNF 11455-11514-11600

NF 6017-6031-6058

The QT may have different story to tell though!

Hi guys,

Can anyone tell me about Mercator shipping in futures tomorrow?..will it reach 57?

thanks GD...i agree. bears won't give up that easily tomorrow....

RM,

You are right. Its not a P-shape profile. It looks like a DD pattern. And I went back to check several examples of such pattern. There can be both possibilities:

1. DD pattern resulting into continuation of today's uptrend as long as price manages to stay above today's POC

2. It could either revisit the lower volume zone of today around 11585-11590

Today's value area as per 5-minute Volume Profile AMI charts is 11521-11609-11639

Since 11680 has been such elusive level with 2 attempted failures on Dec14th and 22nd - I would give higher probability of 11680 (Dec fut) being reached tomorrow and 11585-11590 being protected on the downside. Lets see what happens.

And my lazy trade of long in Jan futures @11510 is up almost 200 points. I hope to see that 11780-11830 reached in a couple of days in Jan fut. Greed has no end :)

@Girish

I was surprised to see the vast difference between Value areas shown by my ami charts and yours. Then saw that I am also getting your values by applying the MPLite AFL!

Re greed, well, we have only two weapons in this war, greed and stop loss!

Post a Comment