Monday, December 27, 2010

Options/futures data for 24th DEC (EOD)

Summary:

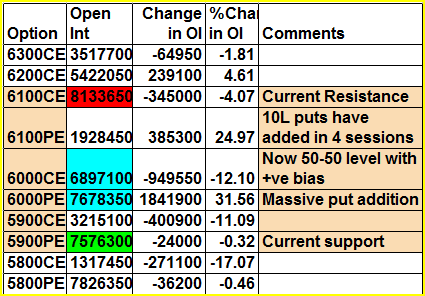

1. Finally, Santa did come on Friday and took Nifty above 6000 barrier. The options action was pretty bullish too. The range suggested by options table is still 5900-6100 for this expiry.

2. 6100 is now the resistance with 81L calls vs 19L puts - although puts are betting added slowly @6100

3. 6000 is now a 50-50 level with positive bias because of call massive covering/put writing action on Friday

4. 5900 has become a strong support now.

5. PCR jumped from 1.35 to 1.41!

Nifty Futures:

2.1Cr OI down 4.5% (10L shares cut)

68L OI up 14% (8L shares added) -- 20% less rollover

Banknifty Futures:

12.2L OI down 3% (0.4L shares cut)

3.6L OI up 22% (0.66L shares added) -- higher OI addition for the third day for BN. All I can say is that a bigger move is coming. Watch 11680 for a move to come on upside and 11330 for move on lower side.

Subscribe to:

Post Comments (Atom)

1 comments:

Thanks Girish!

Post a Comment