Summary:

1. Options table got a "make over" after that gap up! 6100 got shifted from resistance to 'balanced level' with strong call covering and massive put writing. Interestingly even some 6200PEs were written suggesting the bullish undertone!

2. 6200 is now the first resistance with 42L calls vs 12L puts and call writers are now scared to write 6200/6300CEs too. Only 6400CEs are being written.

3. 6000 remains strong support with 60L of OI @6000PE.

4. PCR has inched up from 1.2 to 1.28

Nifty futures:

2.52Cr OI up 3.5% (8.5L shares added)

Banknifty Futures:

17L OI up 5.7% (0.9L shares added)

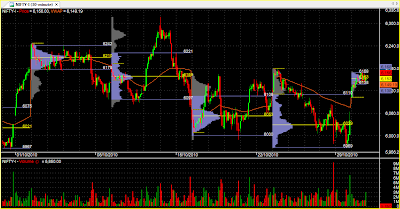

Weekly charts:

Interestingly, 5967 was the VAL from last week of September & Nifty found support, pretty closet to that level and a sharp bounce came - just the wasy it did on expiry day in September

1 comments:

Thanks Girish!

Post a Comment