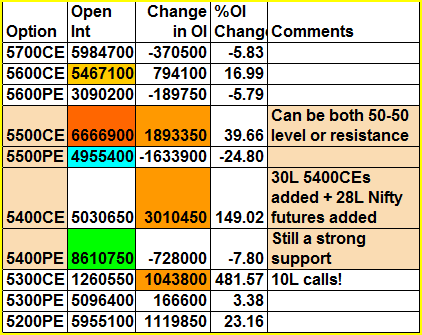

1. The options table seems to have become simpler due to Friday's bear party. The range is now narrowed down to 5500-5400. So something has to happen this week on the downside or upside. From the looks of it, the bears have taken the initiative by adding Almost 59L calls @5300-5500.

2. 5500 can viewed as either resistance or 50-50 level because that's the only strike that has largest call OI (67L). At the same it has close to 50L puts too.

3. Eventhough market has fallen below 5400, as per the optipns data 5400 is a strong support because of 86L puts vs 50L calls. Its not easy to break a level with 80L+ puts in one day. So we need follow up selling, put covering and call writing at 5400 to break the support.

4. There were some (10L) 5300CEs written on Friday. But 5300 still 5300 puts are way too many to make any damage as of now.

5. PCR got crushed from 1.24 to 1.1 with Friday's butchering.

Nifty Futures:

2.47Cr OI up 13% (28.9L shares added) -- That's probably one of the highest OI addition in the past few months on any given day. If this is viewed with 30L 5400CEs added on Friday, are these part of covered calls?

Banknifty Futures:

11.8L OI flat -- Eventhough Banknifty almost kissed the low of Jan 17th and returned, not much OI addition is seen. SBI is still almost 5% above its Jan mid Jan low of 2470(fut). So the contributors to this fall are ICICI & HDFCBANK

Below 10380 we have only 10305 from August and a bigger fall below that might take BN to 4-digit numbers

2 comments:

I never thought we would have to revisit these charts but here are the monthly chart of August for both Nifty and BN

http://1.bp.blogspot.com/_xQfPkpQXjMc/TH0rWm0b6oI/AAAAAAAAAw4/-Elc04EUP1A/s1600/Nifty_VWAP.GIF

http://4.bp.blogspot.com/_xQfPkpQXjMc/TH0rRyBhI0I/AAAAAAAAAww/wRotnVrAlJE/s1600/Banknifty_VWAP.GIF

new psot

Post a Comment